The new year starts off slowly in the January 2 week. Monday is a federal holiday with full market closures. Release of the economic data is minimal on Tuesday. Most of the reports are crowded into the last three days of the week. Note that the calendar includes some release dates that are pushed back a day later than normal because of the holidays. These include the ISM manufacturing and services indexes which will be the second and fourth business days of January, respectively (normally the first and third). The ADP National Employment Report will be reported on Thursday, not Wednesday.

I’ll also note that this is the time of year to remain alert to annual revisions in the data. The first one to watch out for is the Employment Situation for December at 8:30 ET on Friday.

The Household Survey in the monthly employment report will see its annual revisions which could mean some changes to readings for series like the unemployment rate, labor force size and composition, participation rate, etc. Most of these revisions will be small and not change the overall picture of the labor force. The revisions will go back 5 years.

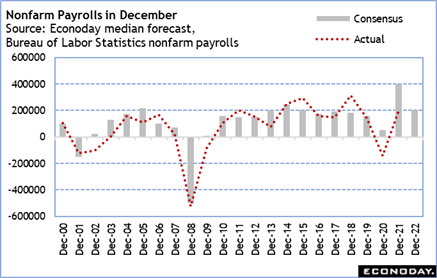

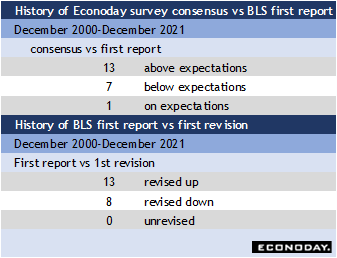

The Establishment Survey will not have its annual revisions until the January report to be released on Friday, February 3 at 8:30 ET. This will make forecasting the December nonfarm payroll number easier, but the January change will be difficult. Forecasts for January nonfarm payrolls have a consensus of up 200,000. This would be below the pace of recent gains but still a solid performance. Job openings remain plentiful. Now that there is a little easing in labor market conditions, businesses are hiring, albeit cautiously in the face of a possible recession. As I’ve said before, where the last few recessions have resulted in a jobless recovery, the current conditions are a layoff-less slowdown.

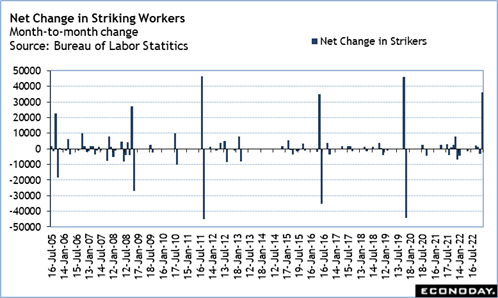

There’s reason to look for a downside surprise in the forecasts. The survey reference period includes a large strike of 36,000 workers at some universities in California. This could cut into the overall total. However, it should be noted that workers who come off payroll counts during a strike are added back on when the strike is settled. If the headline is below consensus, this is a likely cause. If the headline is at or above consensus, it would suggest greater underlying strength in the labor market.

Payroll forecasts for December have a tendency to come in above consensus estimates, and also lean toward being revised up in the subsequent report.

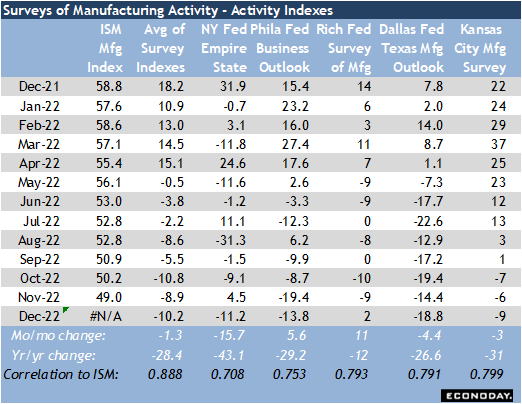

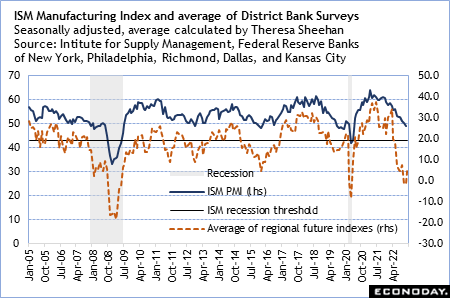

The ISM Manufacturing Index for December will be released on Wednesday, January 4 at 10:00 ET. There have been hints of moderation in the decline in factory sector activity from November, but overall the ISM index is likely to remain mired just below the neutral mark, but not quite into recessionary territory.

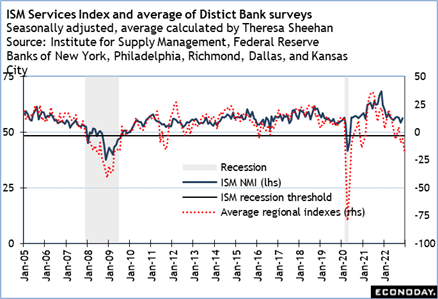

On the other hand, the ISM Services Index for December at 10:00 ET on Friday, January 6 could well show conditions in the service sector have deteriorated since the November report. The five District Bank surveys of manufacturing all point to weaker conditions. Services may not be quite in recession either, but definitely are expanding more slowly.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings. The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day.

The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day. Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.

Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.