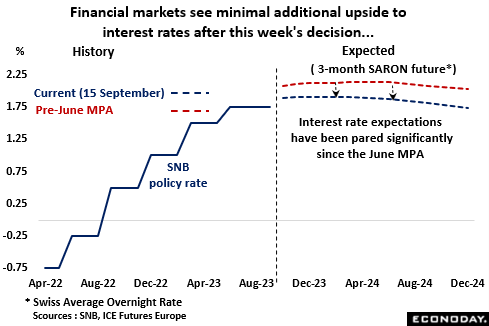

Speculation about another tightening at this week’s Monetary Policy Assessment (MPA) has eased somewhat in the wake of the recent slew of weak real economy data, sub-2 percent readings on both headline and core inflation, and local currency strength. The last change in June lifted the policy rate by 25 basis points to 1.75 percent, its fifth successive increase in the current cycle but also the smallest. Since then, the official rhetoric has remained moderately hawkish but lacked some of its earlier conviction. Still, the market consensus is that the central bank’s determination to get inflation sustainably below 2 percent means another 25 basis point hike is more likely than not. If so, the benchmark rate will climb to 2.0 percent, its highest level since 2008 and bring the cumulative tightening delivered since June 2022 to 250 basis points.

However, looking further out, interest rate expectations in financial markets have been trimmed noticeably since the June MPA. At that time, futures were pricing in a peak to 3-month rates of more than 2.10 percent but that has been pared to currently about 1.90 percent next quarter. Moreover, by the end of next year, rates are seen declining to just over 1.70 percent.

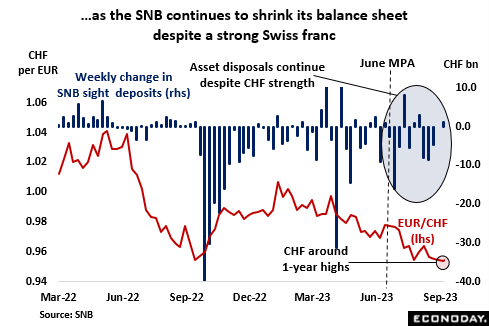

Swiss franc strength might be an issue limiting any further tightening this week. At currently EUR/CHF0.955, the local unit is around a 1-year high against the euro and about 2 percent firmer than it was at the time of the June MPA. However, the SNB has continued to shrink its balance sheet, maintaining a solid pace of asset sales and the currency has remained above the psychologically important CHF0.95 level. Perhaps more importantly too, the unit has also been relatively stable since late-July. For a while now, the central bank has accepted that a strong franc is a useful plank in its efforts to get inflation under control but has also indicated that it is not prepared to tolerate excessive volatility. Fortunately, with the ECB having opted to hike key interest rates just last week, the risk of a sharp appreciation on the back of a unilateral SNB tightening has been removed. A 25 basis point hike on Thursday would simply restore interest rate differentials to what they were before the ECB’s action, rather than narrow them.

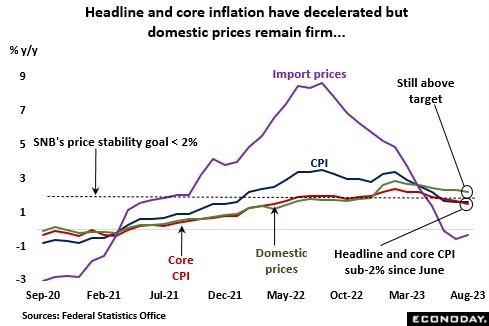

In the main, inflation news since the last MPA has been favourable and both the annual headline and core CPI rates have been below the SNB’s near-2 percent target since June. That said, the deceleration has been largely due to import prices where the rate has fallen particularly sharply, from a peak of 8.6 percent in August last year to currently minus 0.3 percent. The drop in the domestic component, upon which the SNB will be much more focussed, has been markedly shallower, from February’s 2.8 percent high to 2.2 percent and so still above target.

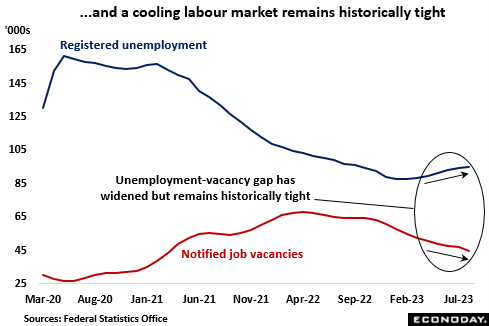

To this end, the labour market is still seen as a threat to price stability despite conditions having clearly loosened since February. Over the last six months, registered unemployment has risen nearly 8 percent, lifting the number of people out of work to the highest level since July last year. At the same time, job prospects have deteriorated further with the unbroken decline in vacancies that started back in May last year having recently accelerated. As a result, the unemployment-vacancy gap is now the widest since the end of 2021. All that said, it remains historically narrow and possibly not wide enough to convince the SNB that there is enough spare capacity to accommodate any surprise increase in demand without boosting prices.

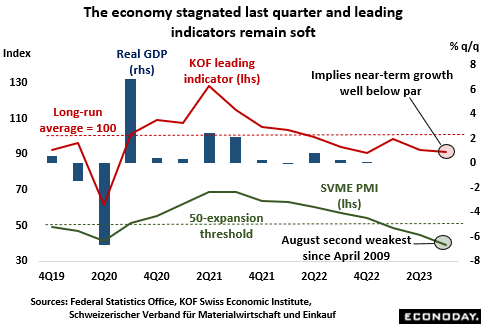

Economic growth dried up in the second quarter when real GDP only matched its first quarter level. This was the second time in the last three quarters that total output has stagnated. Household spending (0.4 percent) actually held up quite well as services benefitted from an ongoing post-Covid rebound but with retail sales slumping in July, the current quarter could well be more sluggish. Companies certainly seem to have become much more cautious and investment in fixed assets and software nosedived 3.7 percent last quarter, its worst performance since just after the pandemic arrived. Net foreign trade made a small positive contribution but only due to exports (minus 2.5 percent) falling less sharply than imports (minus 7.0 percent). However, importantly, the decline in the former seems to reflect more the weakness of overseas demand rather than competitive losses caused by the level of the franc. In fact, exporter sentiment is positive. Nonetheless, more generally, forward-looking indicators like the KoF’s leading index and S&P’s PMI survey suggest no significant pick up in momentum through year-end.

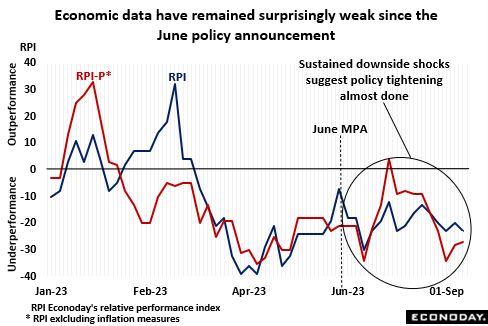

In fact, almost without exception, economic news has continued to surprise on the downside since the June MPA. Econoday’s relative performance index (RPI), which measures overall economic activity versus market expectations, has remained consistently sub-zero. Moreover, bar a very short-lived blip higher in late-July, its RPI-P counterpart which excludes inflation measures has followed suit. Such persistent underperformance suggests that the policy tightenings already introduced have had a significant impact on the economy, and possibly more of an effect than the SNB anticipated.

In summary, recent economic developments suggest that the SNB’s tightening path should be very close to, if not already at, its peak. The central bank’s determination to reinforce its anti-inflation credibility still tilts the odds in favour of another 25 basis point hike this week but the accompanying statement should at least hint that key rates are unlikely to go any higher. Should rates stay on hold, expect a more hawkish communique that warns that a pause in tightening does not necessarily mean that the cycle is complete.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings. The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day.

The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day. Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.

Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.