Little is expected from Thursday’s policy announcement. A very sizeable consensus sees Bank Rate being left at 5.25 percent and investors and financial markets alike seem quite convinced that the next move will be down, albeit not until well into 2024. Comments early last month from BoE Chief Economist Huw Pill essentially concurred with this view and have left most simply wondering about when, and how quickly, the rate cuts will be delivered. That said, recall that in November, three MPC members (Jonathan Haskell, Catherine Mann and Megan Greene) all still wanted a 25 basis point hike and the ongoing stickiness of wages could well see some or all of them renew their call to tighten this week.

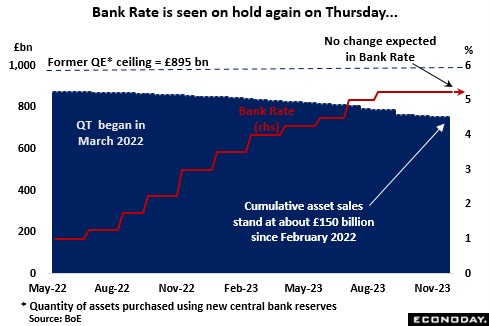

Meantime, the bank continues to drain liquidity via its QT programme. In September, the MPC announced that over the 12 months beginning in October, asset sales would aim to reduce the stock of gilts held in the Asset Purchase Facility by £100 billion to £658 billion. As of early December, overall disposals stood at about £150 billion, implying a near-17 percent decline in the stock of QT to £745 billion since its peak in the first quarter of last year. There is no reason for supposing that the current policy will be amended.

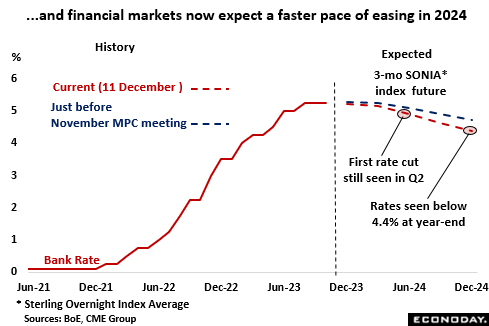

Compared with a month ago, financial markets have become more certain that Bank Rate has peaked and anticipate a faster pace of easing through 2024. The MPC meeting in June is seen currently as the most likely to deliver a 25 basis point cut. Beyond that, expectations have also been trimmed and futures now put 3-month money rates just shy of 4.4 percent at year-end, about 30 basis points or so lower than thought likely previously.

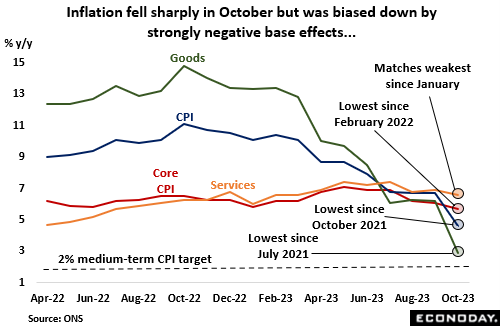

Inevitably, much will depend upon inflation which, in large part due to an energy-induced spike in prices a year ago, fell very sharply in October. At 4.6 percent, the headline rate was down from 6.7 percent in September, its steepest drop in more than 30 years and its lowest mark since October 2021. More importantly, the core rate declined too and at 5.7 percent matched its weakest mark since February 2022. The bank’s own inflation survey released last week also found household expectations for the coming year softening from 3.6 percent in August to 3.3 percent, a 2-year low. However, more ominously, the 5-year ahead rate climbed to 3.2 percent from 2.9 percent. Indeed, while the broad-based deceleration in actual inflation bodes well for a trend decline over coming months, the bank will note that all the main measures remain well above the 2 percent target and will be alert to the fact that future falls will be increasingly dependent upon softening domestic pressures. All of which keeps the labour market in sharp focus.

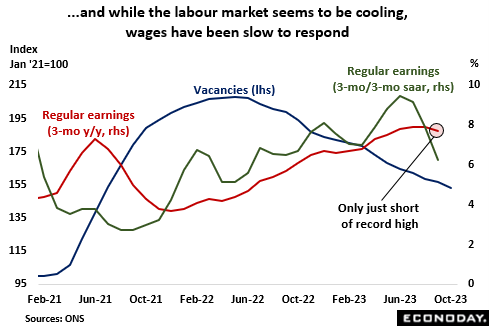

Unfortunately, conditions in the labour market remain far from clear. Since September, the Office for National Statistics (ONS) has been unable to provide a reliable monthly labour market report due to inadequate survey responses. This has left the employment data being estimated by applying implied growths from the Pay As You Earn (PAYE) Real Time Indicator (RTI) series, itself very volatile and often subject to sizeable revision. Unemployment has been modelled by applying implied growths from the Claimant Count series, itself no longer recognised as a National Statistic and, since 2015, deemed only an Experimental National Statistic. The bank recently warned that the official employment data could be out by as much as one million. For what it is worth, in general the picture would seem to show tight, but gradually easing, conditions with, in particular, steadily declining vacancies which hit more than a 2-year low in the three months to October.

Even so, wages have been slow to respond. Headline third quarter regular earnings growth (7.7 percent) was just a couple of ticks below its record high and nowhere close to being consistent with the 2 percent inflation target. The bank’s seemingly preferred metric, which annualises the latest 3-month change, has recently been better behaved but, at currently 6.3 percent, it too remains uncomfortably strong. Moreover, on this basis, the key service sector (7.4 percent) is still particularly robust.

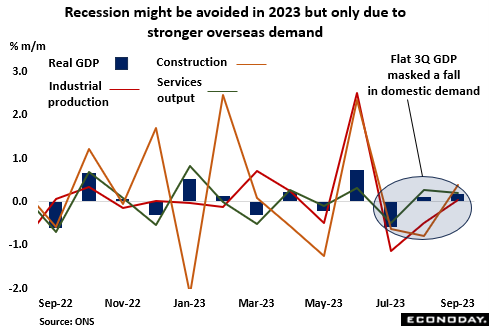

As things currently stand, the economy will avoid recession this year as GDP managed to hold flat in the third quarter. However, the reprieve could easily prove short-lived with domestic demand weak and export volumes at best flatlining. In particular, retail sales have fallen in three of the last four months and in October hit their lowest level since the Covid lockdown in February 2021. Consumer confidence has improved but remains historically weak. Manufacturing is stagnating but declining orders point to worse to come and company insolvencies have hit their highest levels since the aftermath of the financial crisis. The ailing housing market has recently shown some signs of life but an estimated 1.6 million homeowners will see their current mortgage deal expire next year and replacement loans will be much more expensive. All in all, economic prospects do not look good but if there is to be a recession, on current trends it at least looks likely to be only shallow.

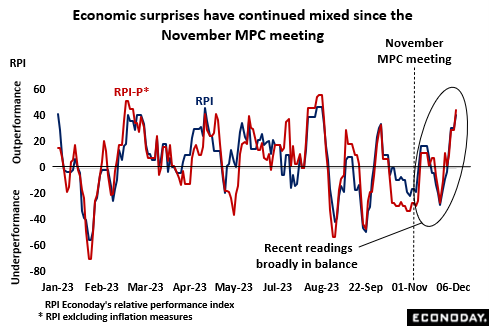

All that said, while surprises in the data have remained quite evenly balanced since November’s meeting, the most recent reports have clearly exceeded expectations. At currently 41, Econoday’s relative performance index (RPI) stands at its strongest level since mid-August and indicates economic activity in general outperforming forecasts by some margin. Ignoring inflation, the RPI-P is even higher at 45. Such readings increase the likelihood of a split vote.

Against this backdrop, it looks likely that only a majority of MPC members will again settle for no change in Bank Rate on Thursday. There are some participants, notably arch-hawk Catherine Mann, who believe that policy has only recently become restrictive and even then, not by much. So near-term, the risks to stability probably remain biased towards additional tightening rather than an early rate cut. In any event, expect the MPC to emphasise the need to maintain a restrictive stance for an extended period to ensure that the inflation target is achieved within an acceptable timeframe. Any early cut in Bank Rate is simply not on the table.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings. The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day.

The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day. Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.

Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.