At the midpoint of the March 18 week is the release of the FOMC statement and summary of economic projections (SEP) at 14:00 ET on Wednesday followed by Chair Jerome Powell’s press briefing at 14:30 ET. There’s nothing on the data calendar in the days before the FOMC deliberations that is likely to change the outlook for monetary policy, and nothing immediately after that might trigger a rethink.

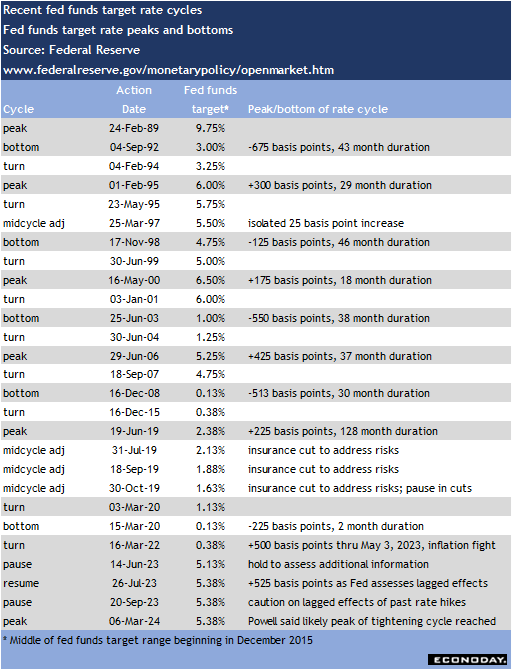

In his semiannual monetary policy testimony on March 6-7, Powell indicated that the current fed funds rate is probably at the peak of this tightening cycle. The fed funds rate range is currently at 5.25-5.50 percent where it has been since July 2023. With little prospect of another rate hike, the burning question becomes when will the easing cycle begin?

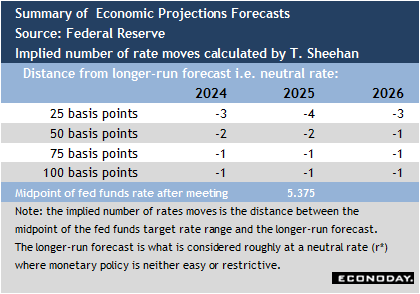

The update to the SEP should provide an answer, at least where FOMC forecasts stand. Powell has said that expectations are for rate cuts later this year if, however, the economic data support it. Since Powell’s testimony, the data point to a still tight labor market with little sign that conditions are loosening materially, and that underlying inflation is not returning to the Fed’s two percent objective quite as quickly. Shelter costs remain elevated and non-housing services are not decelerating as much as commodity prices. This may mean that the previous forecast for 75 basis points in cuts in the fed funds rate in 2024 could be altered to imply less reduction in the fed funds rate this year, or even to delay a cut until next year out of an abundance of caution in the fight against allowing inflation to be become entrenched.

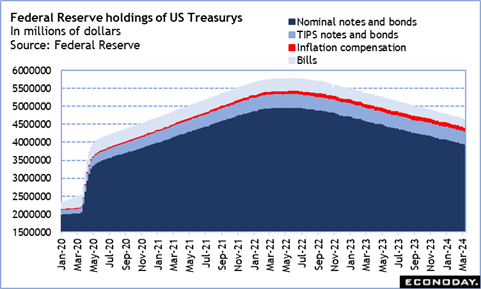

Any changes in the SEP are likely to dominate the questions posed to Powell at his press briefing. However, he is also likely to touch on so-called QT – quantitative tightening – in his prepared remarks and get a number of questions on the topic. Powell indicated at his recent testimony that the March FOMC is one where policymakers are planning a “deep dive” into the progress made in reducing the size of the Fed’s reserve holdings at depository institutions which are now down about $1.5 trillion since the peak in June 2022. Powell has said in the past that the ultimate size of the balance sheet needs to allow for policy that maintains “ample liquidity”. What that size is has been vague, but something in the neighborhood of where it was before the pandemic or a little larger is a reasonable guess. In any case, policymakers will want to further remove the stimulus arising from its large balance sheet so the Fed can get back to relying on interest rate policy.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings. The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day.

The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day. Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.

Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.