Forecasters are convinced that there will be no change in Bank Rate this week. At February’s announcement the MPC’s principal dove, Swati Dhingra, was the sole voice calling for a 25 basis point cut. She was easily outnumbered by the six members voting for no change and even by the two main hawks (Jonathan Haskell and Catherine Mann) who still wanted a 25 basis point hike. Since then, and following confirmation that the economy slid into recession at the end of last year, most of the more recent data have pointed to renewed growth while the January inflation report was only mixed.

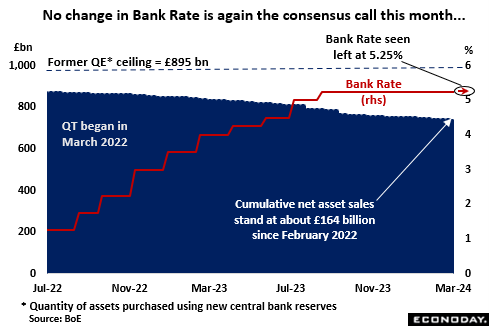

In addition to a steady Bank Rate, there is unlikely to be anything new on the QT programme. Since last September, this has sought to reduce the stock of gilts held in the Asset Purchase Facility (APF) by £100 billion to £658 billion over the year to October 2024 and is well on track. As of mid-March, net disposals had shrunk outstandings to under £731 billion, implying a fall in total QE assets of about £164 billion from their peak level in the first quarter of 2022.

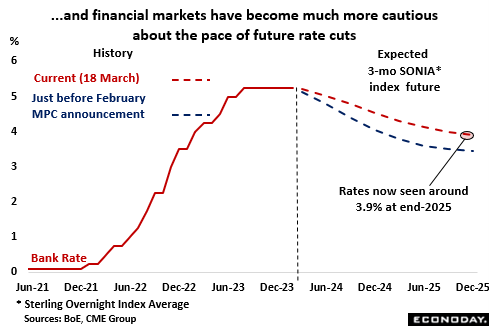

Meantime, the view in financial markets on how low interest rates might go over the next couple of years has changed significantly since the beginning of February. A 25 basis point cut is still priced in for June but by the end of next year, at 3.9 percent, 3-month money rates are seen more than 50 basis points higher than anticipated just before the last MPC announcement.

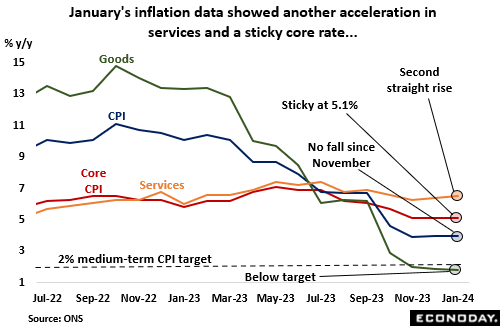

The shift in expectations at least in part reflects some signs that the previously improving trend in inflation is running out of steam. The February data will be updated on Wednesday but in January, the annual headline rate was only steady at 4.0 percent and the core rate similarly unchanged at 5.1 percent, the latter more than 3 percentage points above target. In addition, inflation in services (6.5 percent) edged up for a second straight month. Looking ahead, a 12 percent cut in the energy price cap in April could see the overall rate even dip below 2 percent next quarter but this is likely to be just temporary. A further easing in underlying pressures is needed if the target level is to be met on a sustainable basis and this will require a more marked deceleration in wage growth. Still, the MPC can take some heart from the bank’s latest inflation expectations survey, released last Friday. This found consumers’ view of the rate 1-year ahead falling to 3.0 percent from November’s 3.2 percent and 5-years ahead easing from 3.2 percent to 3.1 percent.

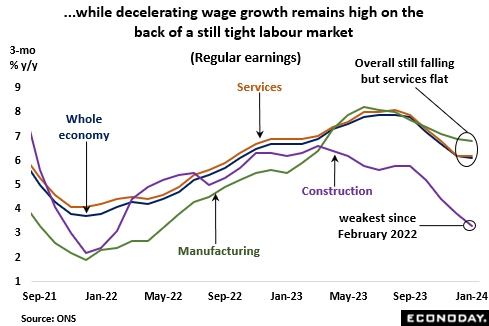

To this end, the latest official data showed a further cooling in whole economy regular earnings. Even so, at an annual 6.1 percent, the rate for the three months to January was only down a tick and still uncomfortably firm. Moreover, in services, where some surveys have pointed to a recent pick-up in wage pressures, the rate was just flat at 6.2 percent. Adding to a sense of caution will be the bank’s own regional agents’ survey which suggested that the average yearly rise in pay settlements in 2024 would be 5.4 percent, only slightly lower than in 2023 and ominously high in the context of the inflation target.

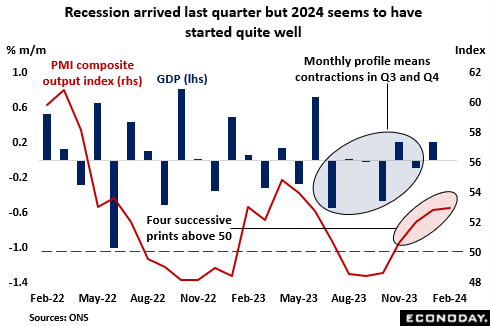

For the real economy, recession arrived at the end of last year when GDP contracted 0.3 percent following a 0.1 percent dip in the third quarter. However, the early indications are that the downturn will be both shallow and short-lived. Total output expanded a monthly 0.2 percent in January and the February PMI survey found activity rising by the most since May last year. Even so, the goods producing sector remains soft so any recovery will be largely attributable to services where a rising headcount is adding to wage cost pressures. Importantly, the March Budget contained few surprises and should have little impact on the BoE’s economic outlook.

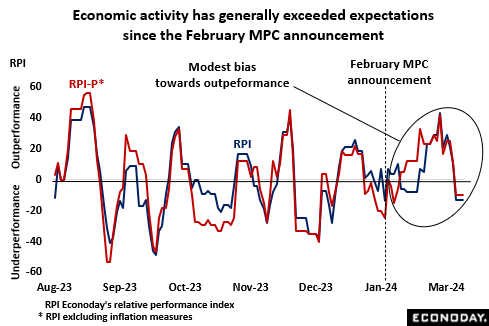

In fact, economic activity in general has proved surprisingly strong since the bank’s last meeting. Econoday’s Relative Performance Index (RPI) has spent most, albeit not all, of the period above zero, averaging 8 to demonstrate a modest degree of outperformance. Moreover, upside surprises in the non-inflation reports have been more marked with the (RPI-P) averaging 12. So far, the apparent recovery from recession has been rather more rapid than predicted by most forecasters.

In sum, Wednesday’s CPI report will have to be very weak to trigger a cut in Bank Rate as soon as this week. Rather, another split vote seems assured with most MPC members probably viewing recent economic developments as a step in the right direction but not going far enough to justify a full-blown ease.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings. The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day.

The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day. Stay ahead in 2026 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.

Stay ahead in 2026 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.