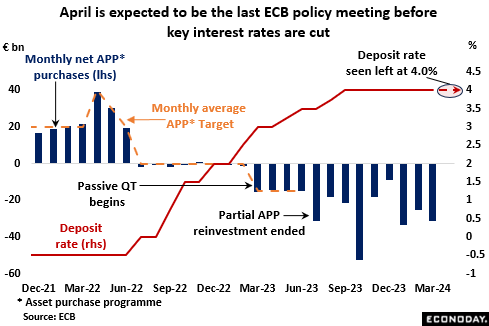

Market participants do not expect the ECB to lower key interest rates on Thursday. Since last month’s meeting, the Eurozone economy has gained some momentum but remains close to recession and inflation has fallen further. However, before delivering any full-blown ease the central bank will want to see June’s updated economic forecasts for confirmation that the March projections, which showed headline inflation below 2 percent and the core rate on target in 2026, are still valid. Consequently, for now, the deposit rate should be held at 4.0 percent, the refi rate at 4.5 percent and the rate on the marginal lending facility at 4.75 percent.

Meantime, the QT programme will continue to shrink the bank’s balance sheet. Net disposals of assets acquired under the asset purchase programme (AAP) amounted to nearly €90 billion in the first quarter, helping to reducing the overall QE stock since February 2023 by a cumulative €320 billion to €2.97 trillion. Net sales will be boosted from July as the pandemic emergency purchase programme (PEPP) is brought into the QT fold with a monthly target of €7.5 billion through December. Liquidity in 2024 will also be drained by the expiration of the final targeted longer-term refinancing operations (TLTRO-III).

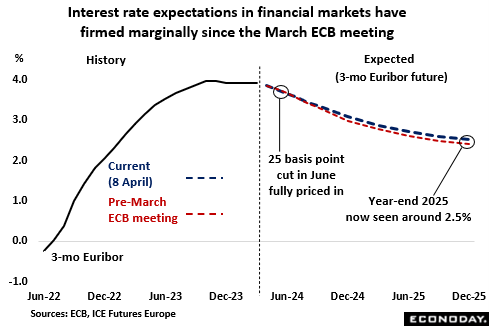

As it is, having been raised significantly between the January and March ECB meetings, interest rate expectations in financial markets have firmed a little more since. A 25 basis point cut is still fully priced in for June but additional easing thereafter is now only seen lowering 3-month money rates to around 2.5 percent by the end of 2025. This compares with about 2.4 percent previously.

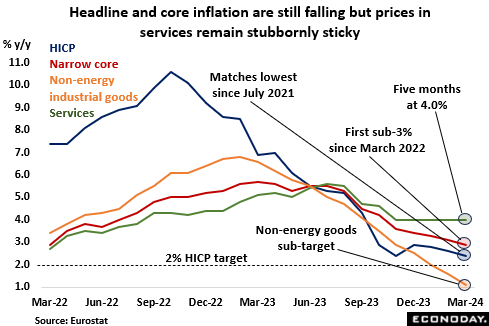

Inflation has behaved itself since the March meeting. The flash data for last month showed the headline rate falling again to 2.4 percent, matching its weakest level since July 2021 and just 0.4 percentage points above its medium-term target. More importantly, there was also good news on the core with the narrowest gauge dropping from 3.1 percent to 2.9 percent, its first sub-3 percent post since March 2022. However, inflation in services remains a problem. The rate here has held steady at 4.0 percent, double the target, every month since last November and with a near-45 percent weight in the HICP basket, poses a real threat to the bank’s price stability goals.

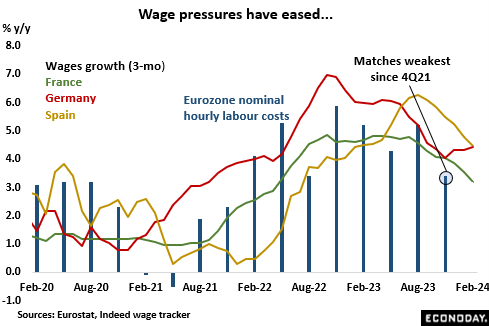

To this end, the ECB will want additional evidence that what is still a very tight labour market will not produce pay rises this year that might stall, or even reverse, the disinflationary progress made to date. Official Eurozone labour cost data are too historic to provide much insight into current developments – the first quarter update is not due for release until 17 June – but at least the trend over the latter half of 2023 was favourable. In fact, growth of nominal hourly costs in the fourth quarter hit its lowest mark since the end of 2021. In addition, Indeed’s more up to date monthly wage tracker has shown a marked deceleration in France, Germany, and Spain in recent months. All that said, current growth rates are still high in the context of a 2 percent inflation target and declining productivity so the bank will be hoping for further falls before its June meeting.

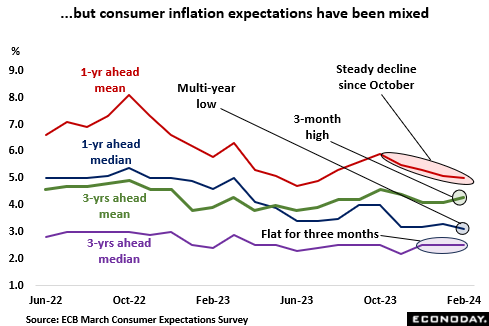

Meantime, the ECB follows inflation expectations very closely and, according to its own survey, recent developments in the household sector have been quite mixed. On the positive side, the latest results released last week found the trend decline in the mean 1-year view extending into February and its median counterpart hitting a multi-year low. However, the median 3-years ahead call has been stuck at 2.5 percent since December while the mean gauge is now at a 3-month high. Moreover, all measures remain well above the HICP target. This is unlikely to sit well with the GC hawks.

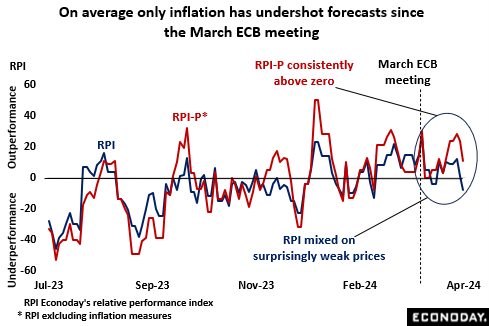

Significantly though, it has been inflation that has undershot market expectations since the March meeting. On balance, real economic activity has surprised on the upside as highlighted by Econoday’s inflation adjusted measure (RPI-P) which remained in positive surprise territory over the entire period. By contrast, the RPI, which includes inflation indicators, has been consistently weaker and on occasions below zero as forecasts of prices have proved too strong. This provides the perfect combination for the ECB inasmuch as it keeps open the door to an interest rate cut while at the same time limiting the pressure to ease potentially too soon.

Most of the recent talk coming out of the central bank has at least hinted that a June cut in key rates is a realistic possibility. Even the more hawkish GC members seem to have come round to that view. Still, if the ECB is to live up to its data-dependent mantra, it will want to see the April and (flash) May HICP data as well as June’s updated Eurosystem staff economic projections before pulling the trigger. As such, this week’s announcement is unlikely to be particularly exciting. In fact, given current market speculation, the risk is probably that the policy statement and press conference are rather less dovish than financial markets are expecting.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings. The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day.

The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day. Stay ahead in 2026 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.

Stay ahead in 2026 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.