Recent comments from a number of MPC members have hinted that a cut in Bank Rate might not be too far away and possibly rather sooner than financial markets currently expect. However, apart from the leading dove, Swati Dhingra, most policymakers would still seem to favour waiting until there has been further progress on reducing inflation. Consequently, there is a strong market consensus in favour of the benchmark rate being held at 5.25 percent on Thursday. There is also a good chance that March’s 8-1 vote for no change will be repeated.

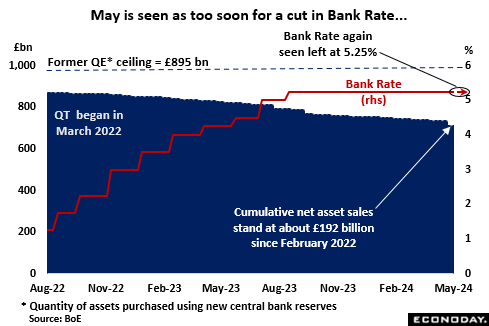

Once again, there is unlikely to be anything new on the QT programme. Since last September, this has sought to reduce the stock of gilts held in the Asset Purchase Facility (APF) by £100 billion to £658 billion over the year to October 2024 and it remains well on track. As of the end of last month, net disposals had shrunk outstandings to around £703 billion, implying a fall in total QE assets of about £192 billion from their peak level in the first quarter of 2022.

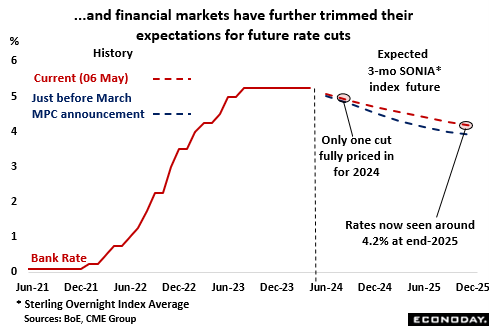

Since the March meeting, financial markets have further downgraded their expectations for interest rate cuts. September is now seen as the most likely month for the first 25 basis point ease with any further reduction not fully priced in until 2025. By the end of next year, 3-month money rates are put at nearly 4.2 percent, some 30 basis points higher than just before the March announcement. In part the more hawkish view would seem to be due to (probably inappropriately large) knock-on effects from diminished easing expectations for Federal Reserve policy but surprisingly firm UK inflation in March was also clearly a factor.

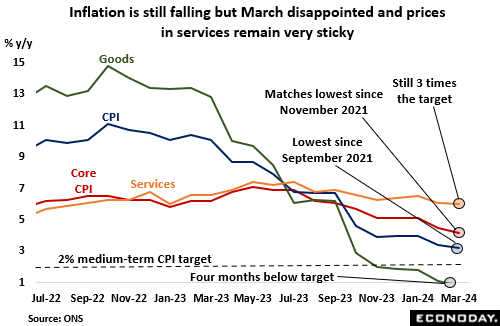

The March inflation update was a little disappointing, showing a surprisingly small fall in the headline rate (3.2 percent) and a core (4.2 percent) still above 4 percent. Some MPC members are clearly worried that the so-called “persistent” component is not slowing quickly enough. Still, the trend remains in the right direction and the bank has already stated that the 2 percent target does not have to be reached before interest rates are lowered. The service sector remains the principal area of concern. At 4.0 percent, inflation here was again unchanged from the level to which it fell back in November last year, dampening rate cut hopes. However, note that services inflation is typically higher than the overall rate. Over the last three decades or so, the sector rate averaged 4.1 percent, or 1.3 percentage points more than the headline figure. If this relationship still holds, it would mean that getting inflation in services down to around 3.3 percent could be enough for the bank to meet its overall CPI target.

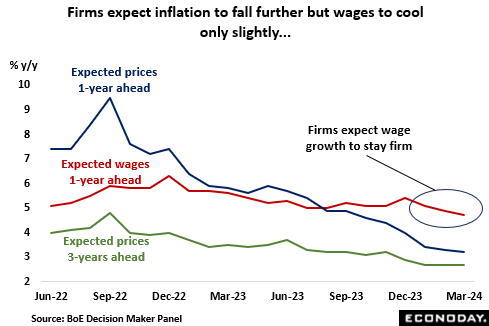

According to the BoE’s March Decision Maker Panel survey which covers some 9,000 executives from small, medium, and large UK companies, firms expect inflation to fall further over the coming year but to remain above 2 percent over the medium-term. On wages, they saw annual growth cooling to 4.7 percent over the coming year. This was down almost 1 percentage point from March 2023 but remains uncomfortably high in the context of meeting a 2 percent inflation target. Note that the April update is due for release on Thursday.

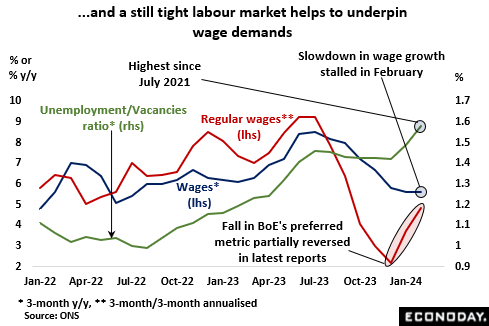

Looking at the official data, the labour market has shown further signs of easing and the first quarter unemployment/vacancy ratio even hit its highest mark since July 2021. However, unemployment is still historically low and, in any event, the bank clearly remains unconvinced about the accuracy on the ONS reports. Indeed, it has indicated that it puts more weight on services inflation and wage growth. To this end, the latter indicator had been showing signs of slowing quite rapidly on the bank’s own preferred quarterly metric but the latest figures have left the picture much more clouded.

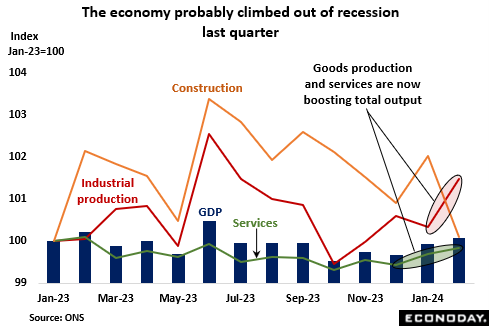

For the real economy, the 2023 recession looks likely to have been both shallow and short-lived. With just March GDP to come (data due Friday) the first quarter is well on course to see a return to positive growth. The recovery should reflect gains in both industrial production and services although construction was probably a drag. That said, most leading indicators still point to only a limited pick-up in activity this quarter, an outcome that would actually suit the bank given its concerns about inflationary pressures in services.

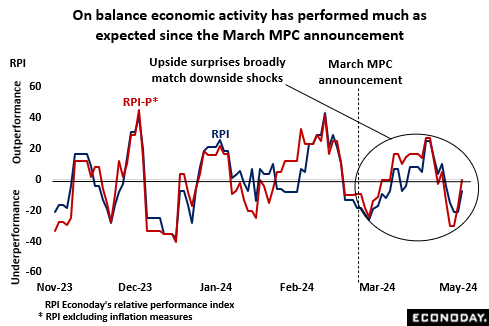

In fact, economic activity in general has not provided too many surprises since the bank’s last meeting. Upside and downside shocks in the data have broadly cancelled each other out leaving Econoday’s Relative Performance Index (RPI) to average minus 4 and, excluding inflation indicators (RPI-P), just 1. These readings should be reflected in little change to the bank’s updated economic forecasts in Thursday’s new Monetary Policy Report, although there could be a slightly softer projected near-term inflation profile.

In sum, despite some more dovish official comments of late, the majority of MPC members still seem to believe that there are more risks in cutting interest rates too soon rather than too late. The economy is still lacklustre and underlying inflation is decelerating but labour market tightness remains a problem. Consequently, any reduction in Bank Rate is unlikely before there has been confirmation of a significant slowdown in wage growth.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings. The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day.

The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day. Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.

Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.