The June 3 week focus will be firmly on labor market conditions and how these might affect the upcoming FOMC meeting on June 11-12.

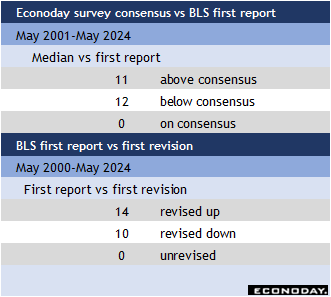

The monthly employment report for May is set for release at 8:30 ET on Friday. The change in nonfarm payrolls will be watched carefully to see if it disappoints or not versus market expectations. In April, nonfarm payrolls rose 175,000, a significant slowing from the first-quarter’s monthly average of 269,000. However, April’s increase reflects a healthy pace of hiring for an economy in modest expansion. Forecasts for May suggest that the upcoming report is expected to deliver a similar number of job gains as in April. If so, the cooling in the labor market would be much as Fed policymakers have anticipated as conditions rebalance and normalize.

There are three special factors that should be kept in mind for the May report. First, this is a five-week reference period for collecting establishment data (April 13-May 18). This slightly longer period could pick up a few extra workers hired late in April who were first paid in May. Second, some June graduates who have secured a job may have been already put on payrolls in May. This often occurs, but if it is more than usual as businesses snap up those with desired skills, it could be more noticeable in the numbers. Third, the relatively early timing of Memorial Day (May 27) might have prompted more aggressive hiring of workers in the travel and leisure sector and brought them on payroll a bit sooner than the normal hiring patterns.

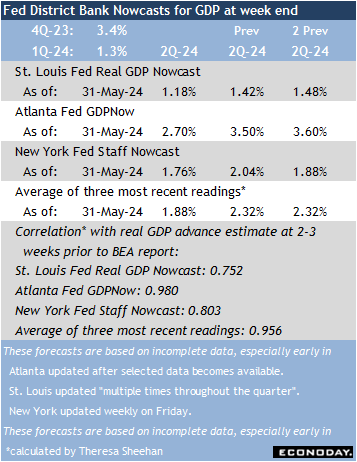

The outlook for monetary policy should not be much changed if the payroll numbers come in close to market consensus. A materially weaker number could spark anticipation of a rate cut sooner, but without the inflation data for May, it would be a few days ahead of things. The CPI for May will be released on Wednesday, May 12 at 8:30 ET and might influence how the FOMC tweaks the language in the statement it will release at 14:00 ET. A cooler labor market combined with a resumption of disinflation might mean the timing of a rate cut looks a bit sooner. A cooler labor market combined with a sideways move or uptick in the CPI – particularly for housing and/or non-housing prices – would mean the FOMC will remain cautious and insufficiently confident about the path of inflation.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings. The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day.

The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day. Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.

Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.