The week contains the federal holiday of Juneteenth on Wednesday. While federal offices will be closed, private offices could be open in order to give their employees a four-day weekend around the Independence Day observance on Thursday, July 4. In any case, stock and bond markets will have a full close on Wednesday.

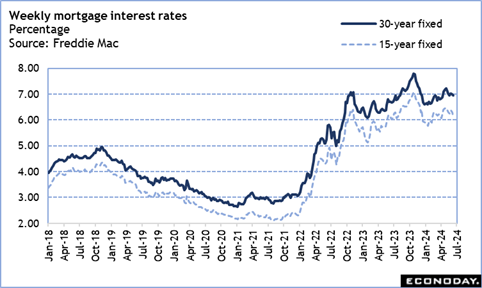

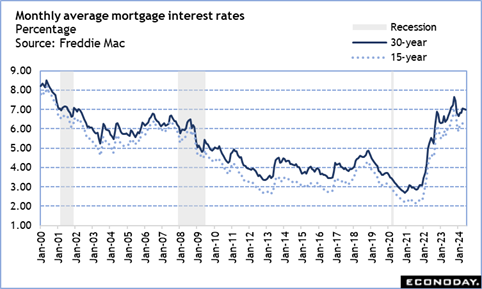

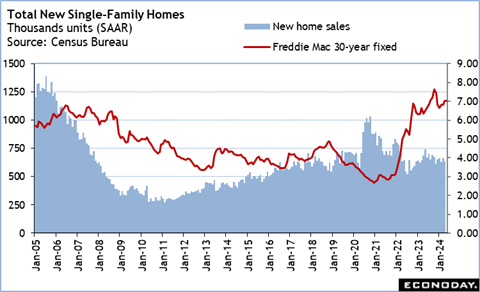

The housing market data in the June 17 week will not fully reflect that financial conditions show little indication of easing now that the FOMC is clearly on hold for interest rate policy at least for the next few months. The upshot is that while mortgage rates may see some week-to-week variation, the average rate is going to remain close to the 7 percent mark which seems to be an important decision point for homebuyers.

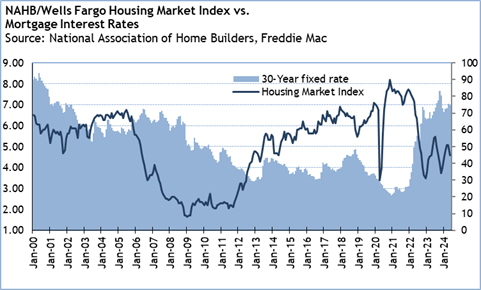

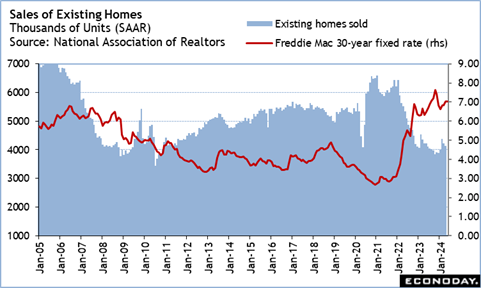

Homebuilders are going to stay cautious about new construction in an environment where prices remain high and current mortgage rates – which are actually pretty normal in the long historical context – remain at levels not seen in over 20 years. New homes have been taking up the slack for a lack of supply in the existing home market, but weaker demand and more existing units coming on to the market will encourage homebuilders to stick with projects where homebuyers have already committed to a purchase. Sales of existing homes will remain highly competitive for the most sought-after sizes and price ranges, but there may be more challenges from signing a contract to closing.

The NAHB/Wells Fargo housing market index for June (which will be released Wednesday at 10:00 ET on the Juneteenth holiday) is likely to look much like the 45 reading in May with homebuilders working to keep from building unwanted inventories of new homes.

Starts of new homes in May at 8:30 ET on Thursday could confirm that homebuilding did not pick up after builders slowed construction, and that permits issued for new homes are putting fewer new projects in the pipeline.

The NAR’s data on sales of existing homes in May at 10:00 ET on Friday should show that closings are down after fewer contracts were signed in April. Data on sales of new single-family homes in May won’t be released until Wednesday, June 26 at 10:00 ET. However, both reports are likely to tell much the same story of weaker sales activity while mortgage rates are discouraging buyers who are being priced out of the market or who can wait until rates are lower to make their decision.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings. The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day.

The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day. Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.

Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.