Economic data with market-moving potential is hard to find for the June 24 week. The calendar is not lacking in reports as the second quarter comes to a close. It is simply that most of the pivotal reports from May are already published and the next wave of data on the labor market and inflation in June are a week or two away.

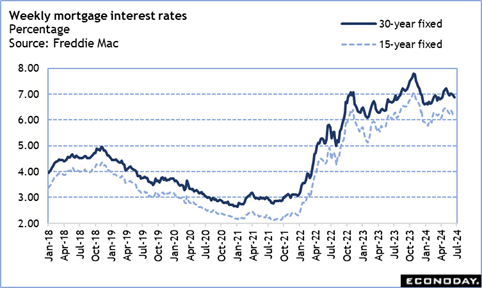

There’s already a good sense that the housing market continues to feel the pinch of mortgage rates hovering near the 7 percent mark back in May. The dip in the rate for a 30-year fixed rate mortgage in the last two weeks won’t be visible in most of the housing numbers for another month. Only the NAR pending home sales index for May on Thursday at 10:00 ET will offer much indication of movement in existing home sales. Contracts taken out in May will reflect rates mostly for April and early May when at least some homebuyers were acting while they had a lock on rates around 6.8 percent and at a time when rates were trending higher.

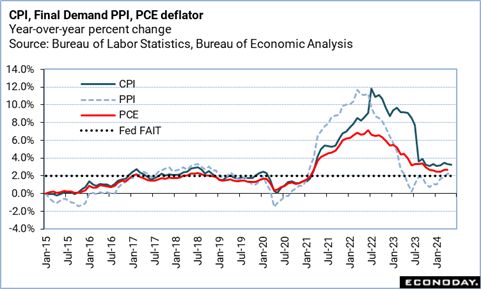

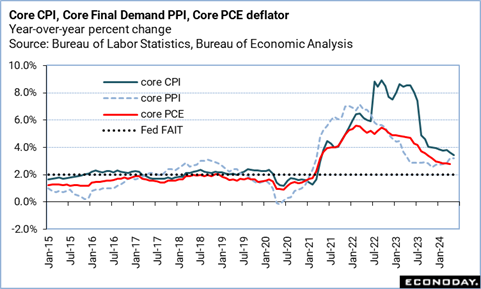

There isn’t much in the way of labor market data during the week, but there is a major inflation report. The PCE deflator for May – part of the report on personal income and spending on Friday at 8:30 ET – could shape market expectations for the timing of a rate cut. Financial markets have not exactly ignored the hawkish tone of comments from Fed policymakers, but do seem to be convinced that the resumption of a mild disinflationary trend will mean that the FOMC will change its tune and cut rates a bit sooner than the current rhetoric would suggest. Policymakers are data-dependent and looking for more than one or two months of minor dips in the inflation measures before shifting the stance of monetary policy.

Perhaps markets will listen when Fed Chair Jerome Powell delivers his semiannual monetary policy testimony before Congress. At this writing, the date of the testimony hasn’t been announced yet. With the Independence Day holiday in the July 1 week and Congressional recession the following week, it isn’t likely to take place before mid-July. If so, it will only precede the July 30-31 FOMC meeting by a short period. It would be highly unusual for the testimony to take place within the communications blackout period (midnight Saturday, July 20 through midnight Thursday, August 1) around the meeting. That leaves a narrow window in the July 15 week.

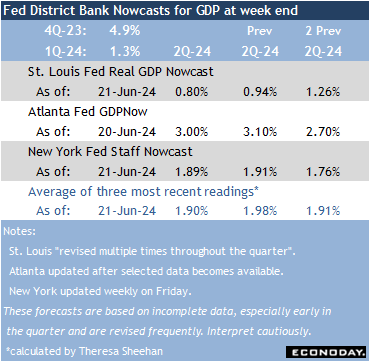

The third and final estimate of first quarter GDP is set for release at 8:30 ET on Thursday. It will put the seal on expansion for the January-March period. However, it is the advance report for second quarter GDP at 8:30 ET on Thursday, July 25 that is now in the sights of Fed watchers. The three Fed district bank GDP Nowcasts are telling somewhat different stories about growth in the second quarter ranging from about up 1 percent to up 3 percent. The midpoint of slightly under 2 percent suggests that growth strengthened somewhat from 1.3 percent reported in the second estimate of the first quarter. Ongoing modest expansion is the sort of scenario that will keep monetary policy on hold.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings. The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day.

The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day. Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.

Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.