The July 1 week includes the Independence Day observance on Thursday when there will be a full close of stock and bond markets in the US. The timing of the federal holiday will cause some shifts in the release calendar, but the monthly employment report will be released on Friday at 8:30 ET as usual.

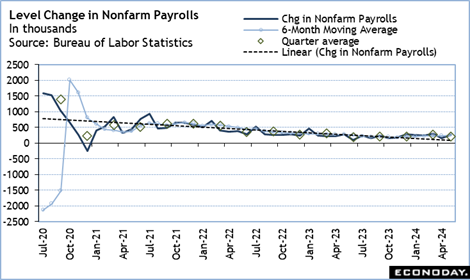

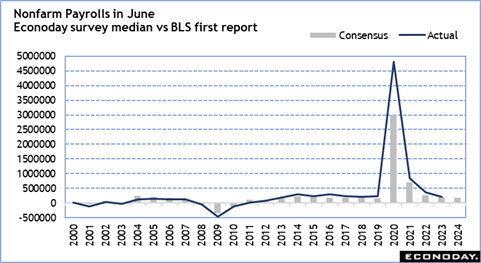

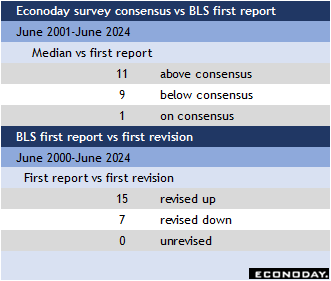

The June employment numbers are anticipated to tell much the same story as has prevailed in recent months. The June unemployment rate is expected to hold at 4.0 percent for a second month in a row. If the rate is a bit higher, it would be by no means high and would not be showing an acceleration in job losses. The change in nonfarm payrolls has early forecasts of around up 175,000. This would represent a modest slowing in the pace of job gains, but certainly not out of line with the underlying trend, and not out of line with FOMC forecasts. Historically, June has a slight tendency to come in above expectations. More importantly, the month has solid tendency to be revised higher in the July report. Right now, the monthly average for the second quarter 2024 looks roughly 200,000 which suggests the labor market remains tight and expansion modest.

The minutes of the June 11-12 FOMC meeting are set for release at 14:00 ET on Wednesday and will probably receive little attention. The release occurs on a day when both the stock and bond markets close early. Many offices will already be clearing out for a four-day weekend. Moreover, the minutes will be three weeks out of date. Fed policymakers have been active with public speaking engagements in recent weeks. Overall, they have been quite clear that the FOMC maintains its hawkish stance on the outlook for interest rates. If markets are anticipating that better inflation data will change policymakers’ views, they may be disappointed. As long as labor market data are healthy and consistent with ongoing rebalancing, any urgency the FOMC might feel about adjusting interest rate policy will be limited. Fed policymakers are cautious and want “greater confidence” that a few months of better data on inflation won’t give way to another “sideways” move in the near future.

Fed Chair Jerome Powell can look forward to many questions about the policy outlook in his appearance at an ECB conference on Tuesday at 9:00 ET, especially in light of June’s PCE data that showed scant monthly pressures and 2.6 percent annual rates both overall and for the core ex-food ex-energy reading.

At this writing, the official Fed calendar does not list the dates of Powell’s semiannual monetary policy testimony, and neither do the Senate Banking Committee or House Financial Services Committee websites. Press reports say that Powell will be before the Senate committee on July 8, which would make the most likely date of his House appearance July 9. Powell is going to face a difficult task in balancing the somewhat better inflation data against the solid readings for the labor market in offering any justifications for keeping rates at current levels.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings. The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day.

The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day. Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.

Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.