There are two important questions for the July 8 week. The first is what will Fed Chair Jerome Powell say in his semiannual monetary policy testimony at 10:00 ET on Tuesday before the Senate Banking Committee? The second is will the June CPI at 8:30 ET on Thursday show disinflation continuing in the second quarter 2024 after pausing in the first quarter?

Powell’s appearance comes on the heels of the release of the minutes of the June 11-12 FOMC meeting and his public comments at an ECB conference on July 2. In looking at the minutes, Fed policymakers clearly were cautious about the outlook for growth and inflation. Nonetheless, there was a solid hint that another month or two of disinflation in the major inflation reports – mainly the CPI and PCE deflator – could bring that “greater confidence” that policymakers seek before cutting rates. Public comment since the meeting has not lost its hawkish tone. At the ECB panel, Powell reiterated that the FOMC can take its time before deciding on a rate cut. While risks to the outlook are more balanced with a cooler labor market and less upward price pressure, the FOMC will wait for the data. Markets should be wary of getting ahead of a firmer signal from policymakers that the FOMC is considering a rate cut soon. That signal may not be too far distant.

The monetary policy report to Congress for June is already written and forms the basis of the Fed Chair’s prepared opening remarks. However, Powell may need to amend the text in light of the June monthly employment report. If he wants to continue to deliver a convincing message about a patient FOMC waiting for greater confidence, he will have his work cut out for him. A noticeably looser labor market and broad signs of resumed disinflation will excite hopes in financial markets of a rate cut sooner rather than later.

Given that this is an election year, expect the Q&A at the hearing to dispense with monetary policy quickly in favor of committee members getting their political message on public record. Powell is likely to be closely questioned about the budget, the value of the dollar, and trade policy – none of which he will comment on other than in the broadest terms and with due deference to Congressional responsibilities. Powell is also likely to be grilled on the topics of supervision and regulation, digital currencies, and his ability to work with whomever becomes the next president of the United States. Expect Powell to update Congress on the first, say nothing has been determined and research is ongoing on the second, and decline to offer any opinion about the political climate other than to say that an independent central bank is important for the economy and financial markets and that Fed policymakers are focused on doing their jobs regardless of politics.

At this writing the second day of Powell’s testimony has yet to be put on the House Financial Services Committee calendar. Normally the Fed Chair testifies on consecutive days and offers the same prepared opening remarks. Depending on how much of a gap there is between Powell’s first and second appearances, there’s the potential for the inflation numbers to shade his comments – in either direction.

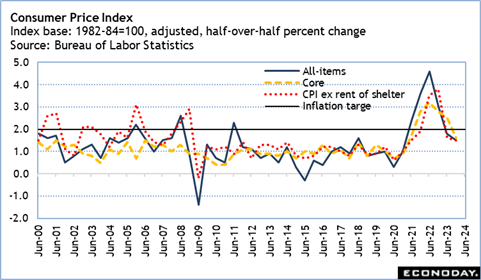

The June CPI may solidify expectations for a rate cut in the near future. It will be harder to deny that disinflation resumed in the second quarter 2024 if the CPI headlines for the year-over-year percent changes nudge a tenth or two lower as anticipated. The story behind the FOMC’s reluctance to express confidence that disinflation is sustained and sustainable back to the 2 percent objective is in core prices and particularly non-housing services prices. In addition to the month-over-month and year-over-year changes, the FOMC may take a look at the CPI half-over-half pace of disinflation. If this suggests upward price pressures are falling quickly enough, then it could make the argument that the time for a rate cut is on the near horizon.

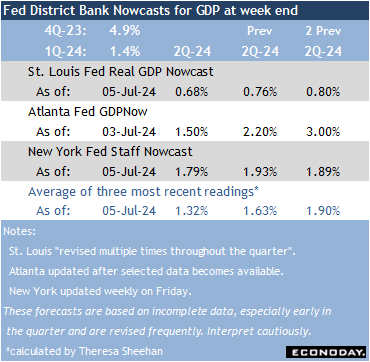

Certainly there is evidence that GDP is finally slowing to below the FOMC’s longer-run estimate of 1.8 percent as its collective forecast has anticipated for some time. The first quarter 2024 dipped to 1.4 percent after a robust 4.9 percent. It looks like growth in the second quarter is going to be similar to the first quarter. The three Fed district bank GDP Nowcasts have been trending lower in recent weeks and are telling a fairly consistent story of mild expansion roughly around 1 percent when the advance estimate of second quarter GDP is released at 8:30 ET on Thursday, July 25. This report will include annual revisions.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings. The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day.

The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day. Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.

Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.