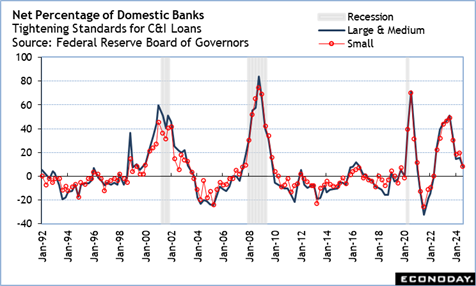

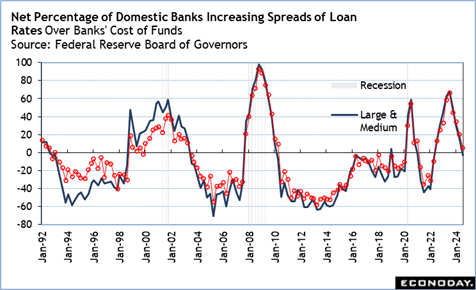

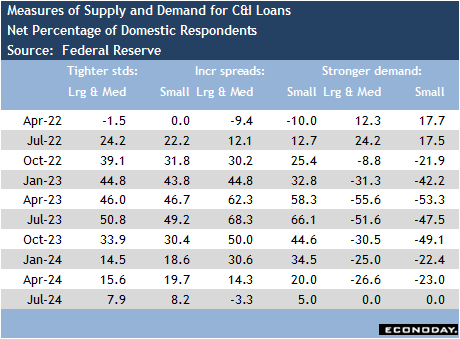

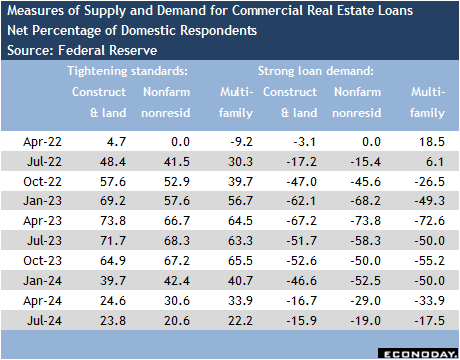

The Fed’s senior loan officer opinion survey for July shows that on net, fewer banks are tightening lending standards for commercial and industrial lending. The increase in spreads of loan rates over banks’ cost of funds is lower for large and medium-sized firms and rising slightly for small firms. Loan demand is about the same as the prior report in April. Lending for commercial real estate loans in all categories show both tighter standards and softer demand.

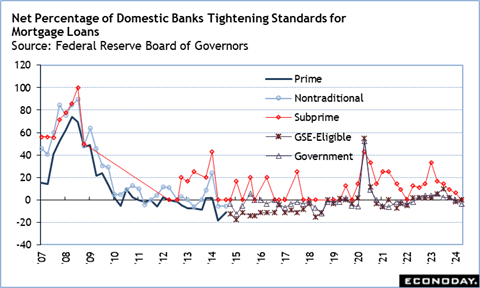

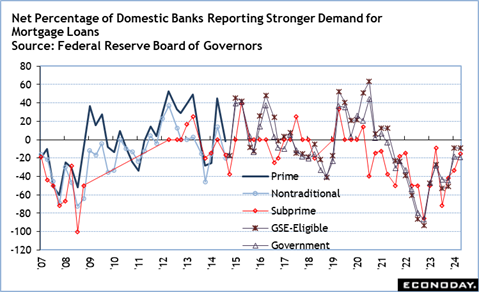

Banks’ lending standards for households are about unchanged in July from the prior report. Demand for home mortgages is down in July. Standards for home equity loans are about unchanged in July as is demand for home equity lines of credit.

The report said, “While banks, on balance, reported having tightened lending standards further for most loan categories in the second quarter, the net shares of banks that reported having tightened lending standards are lower than in the first quarter across almost all loan categories.”

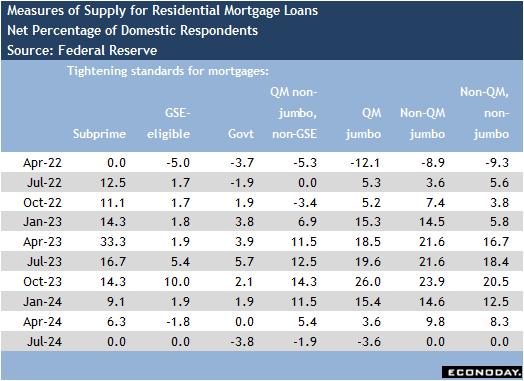

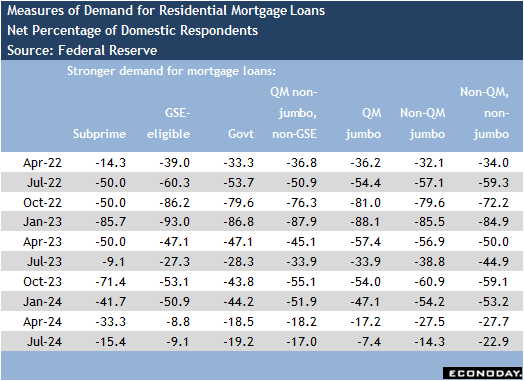

For all types of mortgage loans, standards are little changed in July from April. However, demand for all types of mortgage loans remains weak.

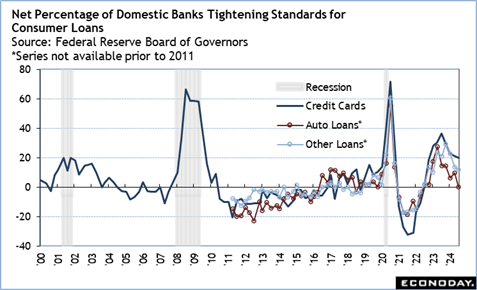

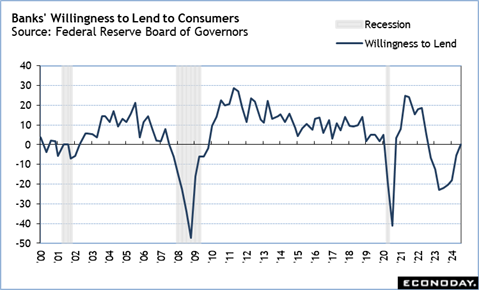

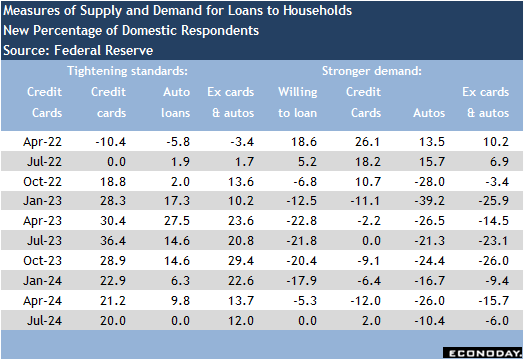

Importantly for households, banks’ willingness to lend in recent months is no longer declining. Standards continued to tighten for credit cards and consumer credit excluding autos and credit cards, while standards for auto loans are unchanged from the prior report. Demand for auto loans and consumer loans excluding credit cards and autos are declining. Demand for credit cards is up slightly.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings. The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day.

The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day. Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.

Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.