The September 2 week starts with the Labor Day observance on Monday with a full market close in the US for stocks and bonds. The data calendar will have a few shifts in the normal release schedule with the weekly MBA numbers on mortgage applications on Thursday instead of Wednesday, and the monthly ADP report also on Thursday instead of Wednesday.

Now that Fed Chair Jerome Powell has given an unmistakable message for a rate cut at the September 17-18 FOMC meeting, speculation will be about the size and timing of future rate cuts. Could the FOMC impose a 50-basis point cut in September rather than the 25-basis points that is widely expected? Will the FOMC forecast one or two more cuts in 2024? Will it pick up the pace for future rate hikes in 2025 and 2026? Could it lower the projected path of the fed funds target rate?

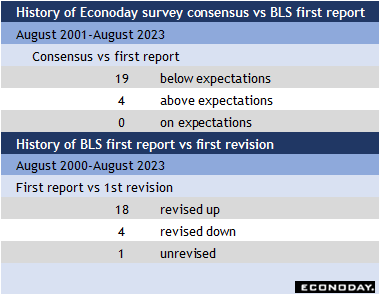

Some of these questions hinge on the contents of the monthly employment report for August when it is released at 8:30 ET on Friday. The July report presented a downside surprise with a payroll increase of 114,000 and a downward net revision of 29,000 to the prior two months, combined with a 2 tenths increase in the unemployment rate to 4.3 percent. The results sparked worries that the labor market was cooling more quickly than previously thought. A second below-expectations report could be more worrisome. However, it should also be noted that nonfarm payrolls frequently come in below the market consensus and are subsequently revised higher.

Early forecasts for nonfarm payrolls look for an increase of somewhere between 150,000-175,000 in August. The unemployment rate is expected to retreat by a tenth to 4.2 percent. If realized, this should offer some reassurance that though the labor market has cooled, it is not worrisomely weaker.

Powell recently said, “We do not seek or welcome further cooling in labor market conditions.” Against this backdrop a weak August employment report could affect the FOMC’s collective forecast when it updates the summary of economic projections (SEP) at the upcoming meeting. But Fed policymakers are going to delve deep into the totality of the data about the labor market, not just one report.

The week will also include important data Challenger numbers on announced layoff intentions for July at 7:30 ET on Thursday and ADP’s national employment report for August at 8:15 ET on Thursday. Other readings on job openings and labor turnover (JOLTS) will be a little behind with numbers for July, but should help shape the labor market picture when the data are reported at 10:00 ET on Wednesday.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings. The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day.

The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day. Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.

Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.