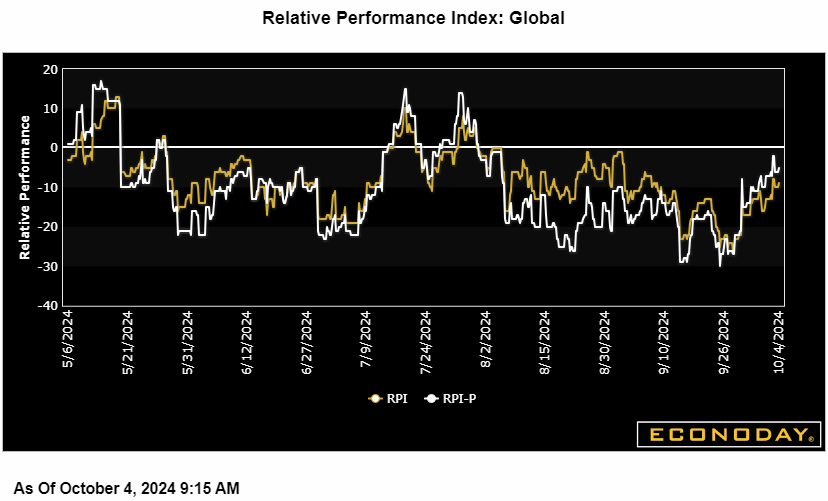

At minus 8, Econoday’s Relative Economic Performance Index (RPI) continues to show recent global economic activity lagging market expectations, but not by much. China in particular remains a significant drag, but Eurozone readings have improved and the U.S. continues to outperform.

In the U.S., a reminder of just how tight the labour market is kept the RPI and RPI-P (both 19) above zero. Overall outperformance versus market expectations has been a feature of the economy since early September and must raise new doubts about how quickly the Federal Reserve will ease policy over coming months.

In Canada, an absence of key data last week left the RPI-P at minus 10 and the RPI-P at 3. Overall economic activity is broadly matching expectations which means financial markets will remain focused on the size of a probable interest rate cut by the Bank of Canada later this month.

In the Eurozone, the RPI (2) just about crept back above zero while the RPI-P (14) made rather more progress. Crucially, the gap between the two measures essentially reflects a surprisingly weak September inflation report and it is this that has significantly boosted the chances of another cut in the European Central Bank’s key interest rates next week.

In the UK, economic data generally last week surprised on the upside and were firm enough to lift the RPI to 17 and the RPI-P to 11. Economic activity in general is now running ahead of expectations but not by much and not to the extent that would provide a clear pointer to how the November MPC will vote.

Much like the Eurozone, positive readings on the Swiss RPI (4) and RPI-P (21) show economic activity running a little stronger than expected. However, inflation continues to surprise on the downside and September’s notably weak report has further boosted speculation about the Swiss National Bank easing again in December.

In Japan, a mixed bag of data was on balance firm enough to keep both the RPI (16) and RPI-P (28) above zero. Even so, the broader picture is less convincing and dovish comments from new PM Shigeru Ishiba have left investors all the more uncertain about when the Bank of Japan will tighten again.

In complete contrast to the U.S., the Chinese RPI and RPI-P both closed out the week at minus 50, extending the unbroken run of sub-zero readings that began back at the start of August. Such readings simply reinforce the need for the national central bank to deliver on the bazooka monetary stimulus package that it announced late last month.

Econoday’s RPI provides a handy summary measure of how an economy has recently been evolving relative to market expectations.

A reading above zero means that the economy in general has been performing more strongly than expected and vice versa for a reading below zero. The closer is the value to the maximum (+100) or minimum (-100) levels, the greater is the degree to which markets have been under- or over-estimating economic activity. A zero outturn would imply that, on average, the market consensus has been correct. Note too that the index is sensitized to place extra weight upon those indicators that investors consider to be the most important.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings. The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day.

The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day. Stay ahead in 2026 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.

Stay ahead in 2026 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.