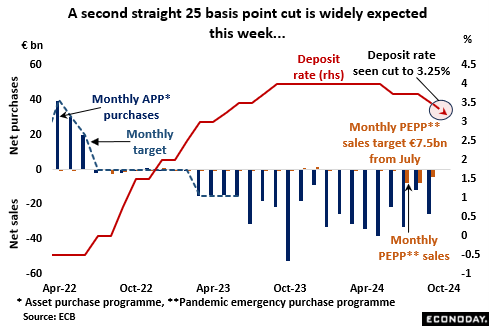

Immediately following September’s well-flagged ease, the ECB seemed happy to hold policy steady until December. However, with inflation having fallen below target last month and the real economy essentially flatlining, forecasters now anticipate a second successive 25 basis point cut in the deposit rate to 3.25 percent this week. That said, in contrast to the unanimous decision last month, October’s outcome could be more finely balanced as some Governing Council (GC) hawks remain concerned about still high wages and elevated inflation pressures in services. Note that having narrowed the spread to 15 basis points last month, the ECB should match any 25 basis point reduction in the deposit rate with an equivalent cut in the refi rate (to 3.40 percent). The marginal lending rate should similarly be lowered to 3.65 percent.

Meantime, the bank’s balance sheet continues to contract courtesy of asset sales from both the asset purchase programme (APP) and the pandemic emergency purchase programme (PEPP). Over the three months since the PEPP was added to QT, combined net disposals were just short of €90 billion reducing the APP portfolio to €2.76 trillion and the PEPP to €1.69 trillion.

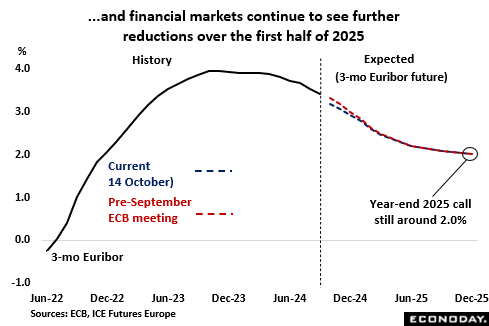

Another 25 basis point cut is more than fully priced in for this week and, at just over 2.9 percent, 3-month money rates are now seen almost 10 basis points lower at year-end than anticipated just prior to September’s meeting. Over the last couple of weeks, financial markets have tempered their medium-term rate cut expectations but only back to where they were in early September. Hence, by December 2025, rates are still expected to have fallen to around 2.0 percent.

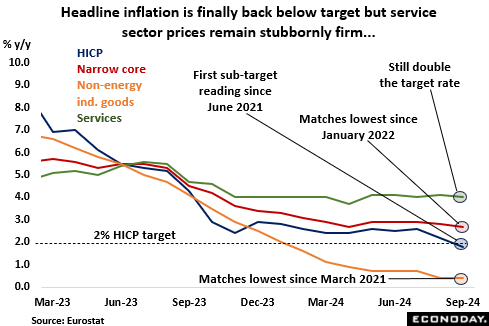

The likelihood of a cut this week was boosted by the flash September HICP report which showed headline inflation sliding below its 2 percent medium-term target for the first time since June 2021. At least as important, the core rates were also well behaved and at 2.7 percent, the narrowest gauge matched its lowest mark since January 2022. Even so, a 4.0 percent rate in services was still double the target and its trend remains only flat. Lingering effects from the Paris Olympics might have been an issue but services continue to be an area of concern. Indeed, sticky prices will probably prompt some resistance from those wary about delivering another cut in interest rates before the presentation of the bank’s next inflation forecast, not due until December.

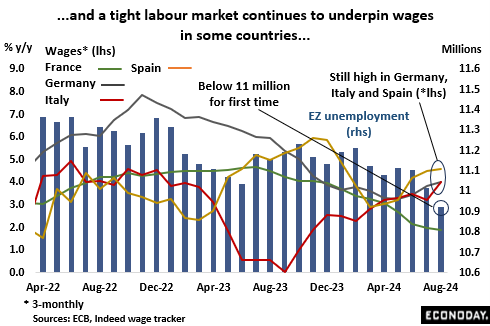

As it is, the labour market has proved remarkably resilient to earlier ECB tightening. Indeed, Eurozone unemployment fell below the 11 million mark for the first time in August and, in some member states, still seems to be supporting wage growth at potentially inflationary levels. According to the Indeed wage tracker, French wages have been cooling quite steadily since the middle of last year and pose no obvious threat. However, in the other Big-3 countries, yearly gains remain significant at 4 percent or higher and have even accelerated in recent months.

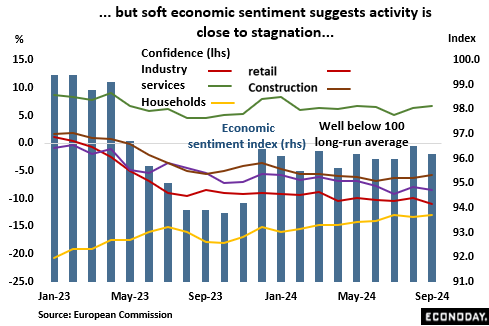

That said, subdued, and probably slowing, economic activity is adding to pressure for lower borrowing costs. The ECB trimmed its growth forecast at the last meeting but with the latest business surveys showing an accelerating fall in new orders, worsening expectations, and a sustained decline in backlogs, it may well have to do so again. Firms face weak demand at home and abroad, ensuring that the European Commission’s economic sentiment index, a measure watched closely by the ECB, remains well below its 100 long-run average. To be sure, current levels point to stagnation rather than expansion. Similarly, retail sales have gone nowhere since the end of last year and, at 49.6 in September, S&P Global’s composite PMI slipped back below the 50-expansion threshold. Regionally performances have been mixed and the Spanish economy for one has actually done well. However, as for the two largest states, Germany’s leading economic institutes are no longer forecasting any growth at all this year and in France, INSEE now expect GDP to shrink 0.1 percent this quarter.

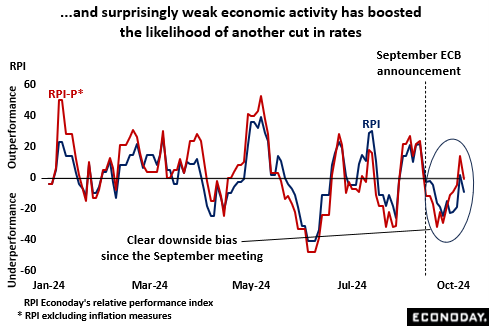

In fact, economic activity in general has generally fallen short of market expectations since the September discussions. Econoday’s relative performance index (RPI) has spent most of the period in negative surprise territory, averaging minus 12, a value matched by the measure excluding inflation shocks (RPI-P). In other words, the broader picture is one of a disappointingly soft economy that could well do with some central bank stimulus.

A move on key interest rates this week would represent a break in the previous link between changes in monetary policy and new ECB forecasts. However, with real borrowing costs having risen since the September meeting, headline inflation below target and an already sluggish Eurozone economy still losing momentum, a third 25 basis point cut looks very likely.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings. The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day.

The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day. Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.

Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.