After the release of the annual revisions and January payroll numbers on Friday, February 7, interest will shift to the price stability side of the Fed’s dual mandate. At the moment the labor market looks solid and an unemployment rate of 4.0 percent is consistent with maximum employment.

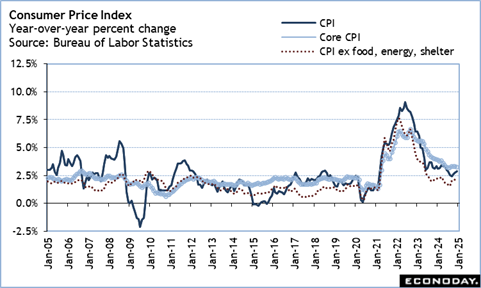

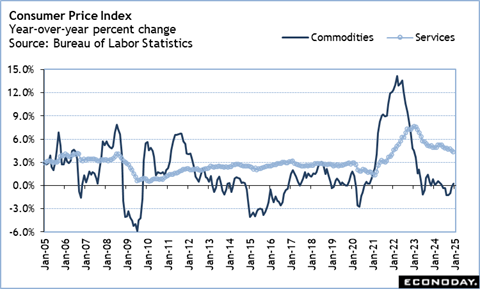

The BLS will release the annual revisions to the CPI along with the January report at 8:30 ET on Wednesday. The revisions typically go back five years. The revisions also typically reflect only small changes in any given month and do not alter the overall picture of changes in consumer prices. The question is if the pace of the year-over-year CPI reflects progress in disinflation at the all-items and core levels that is sufficient to get Fed policymakers thinking about a rate cut again. This is unlikely in the near term with commodities costs rising and services prices falling only incrementally.

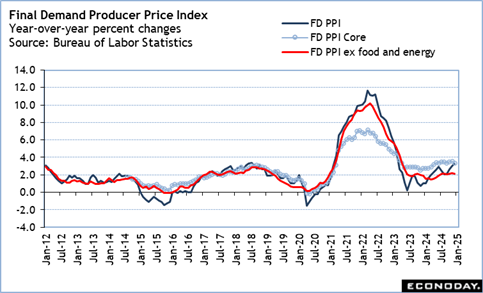

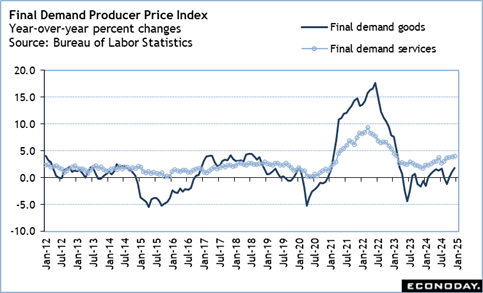

The BLS will release the annual revisions to the final-demand PPI on Thursday at 8:30 ET along with the January report. The report could show if producers are beginning to feel the pinch of higher input costs.

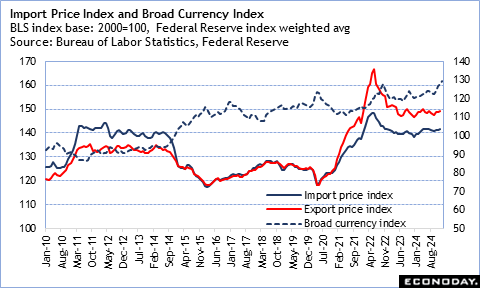

Finally, the report on import and export prices indexes for January is set for release at 8:30 ET on Friday. These indexes are unadjusted and therefore do not get annual revision. The firming in the value of the US dollar versus major currencies in the last few months means imports are going to be pricier and a contributing factor in upward price pressures.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings. The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day.

The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day. Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.

Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.