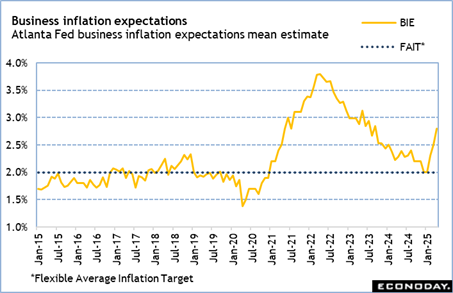

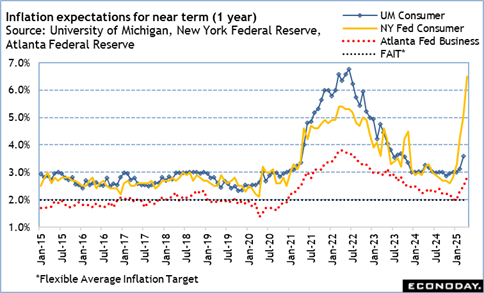

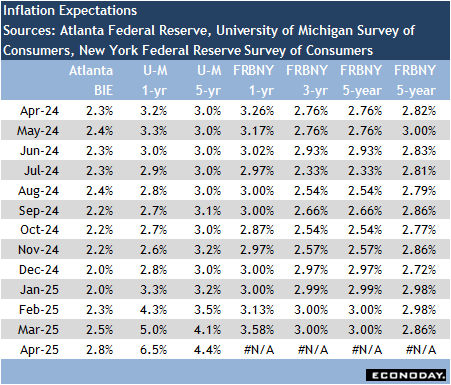

Inflation expectations continue to rise in April as businesses and consumers navigate the choppy waters of the Trump administration’s tariff policy. The reversals of policy probably mean that some of the anticipation of higher prices will ebb in the near future, although it is unclear whether the unease about increased costs will dissipate quickly.

Fed policymakers are keenly aware of the dangers of allowing inflation expectations to lose their anchor and sow doubt about the Fed’s ability to maintain price stability. While the present uncomfortable readings for inflation expectations are likely a consequence of rapidly elevated uncertainties, the FOMC cannot afford to ignore them.

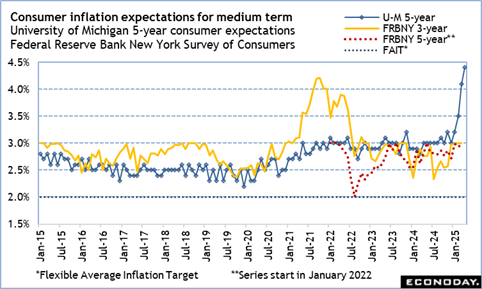

Inflation expectations in the short term (1 year) can be quite volatile and can be downplayed as significant. On the other hand, expectations for the medium term that the FOMC gives more weight are also sharply higher in the last few months. This is where the Fed can see its credibility for fighting inflation eroded. Fed policymakers will have to take this into account in setting policy. It is one more argument for being patient and leaving the fed funds target rate range unchanged at its present 4.25-4.50 percent.

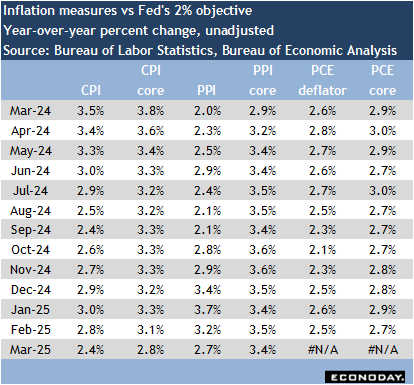

At the next FOMC meeting on May 6-7, the committee will have to deal with data that points to a cooling – but still healthy – labor market, disinflation bringing the inflation measures tantalizingly close to the 2 percent inflation objective, and inflation expectations suggesting the purchasing behavior of consumers and businesses expects higher prices and are buying now rather than later.

That situation could change in the next week or two depending on the advance estimate of first quarter GDP at 8:30 ET on Wednesday, April 30, the PCE deflator in the report on personal income and spending for March at 10:00 ET on Wednesday, April 30, and the monthly employment report at 8:30 ET on Friday, May 2. The next major reports on inflation and inflation expectations will not be released until after the FOMC meeting.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings. The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day.

The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day. Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.

Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.