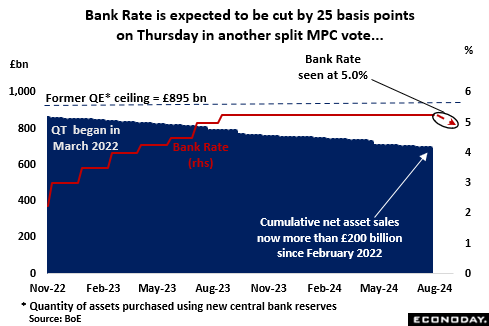

Forecasters are very unsure about which way this month’s BoE MPC announcement will go but, on balance, seem to expect what would be the first cut in Bank Rate since March 2020. However, if so, it is likely to be a very close vote. June saw a relatively clear 7-2 split in favour of no change but official comments since then have hinted that the easing camp might now have a small majority. That said, uncertainty has been heightened by the blackout period for central bank rhetoric in the run up to the 4 July general election and with core inflation still high, a steady policy stance would hardly come as a big surprise. A 25 basis point reduction would put Bank Rate at 5.0 percent, matching its lowest level since May 2023.

A new Monetary Policy Report (MPR) will also be released on Thursday which, in earlier times, might have been seen as increasing the chances of a move on rates. This could still be the case but the size of recent forecast errors and revisions has done much to undermine the report’s credibility. Consequently, Thursday’s updated edition is likely to attract only limited attention. Note too that this week’s MPC meeting will be the first for Clare Lombardelli who has succeeded Ben Broadbent as Deputy Governor for Monetary Policy.

Irrespective of the decision on Bank Rate, the QT programme will continue to run unmodified in the background. Since February 2022, net sales from the Asset Purchase Facility (APF) have amounted to more than £200 billion, reducing the QT stock to just over £690 billion.

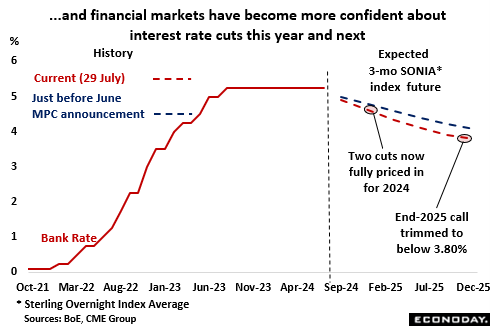

Meantime, financial markets have become rather more optimistic about the chances of lower borrowing costs over coming months and quarters. Two 25 basis point cuts are now fully priced in by December and expectations for the end of 2025 have been trimmed around 30 basis points to less than 3.80 percent, the lowest call since early April.

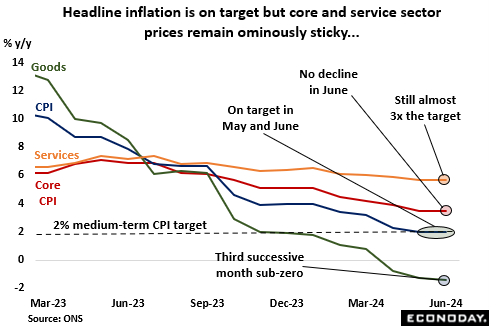

That said, recent developments in consumer prices have been mixed. Having fallen back to target in May for the first time since July 2021, annual inflation held steady at 2.0 percent in June. However, even if the headline rate is no longer a problem for the bank, a number of the key components certainly are. Hence, June’s yearly core rate was also flat but, at 3.5 percent, still some 1.5 percentage points above target. More ominously, service sector prices remain particularly sticky and, at an unchanged 5.7 percent, their yearly rate remains almost three times the target. The lack of any further progress on both these measures is likely to ensure that at least some MPC members will view a rate cut now as premature.

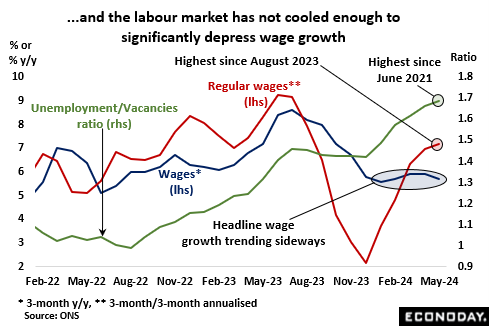

Earnings also remain problematic. The bank has said that its own agents have found some signs of slowing wage growth but the official statistics suggest that any progress has been limited at best. The headline yearly rate decelerated in the three months to May but at 5.7 percent only matched its December-February mark. Moreover, the bank’s preferred metric that uses the annualised 3-monthly change in the regular component continues to rise – hitting a lofty 7.2 percent over the same period. The risk is that while the labour market is cooling – the unemployment/vacancy ratio is now at its highest level since the second quarter of 2021 – it is not doing so fast enough. There is still not enough downside pressure on settlements to bring pay rates into line with meeting the inflation target.

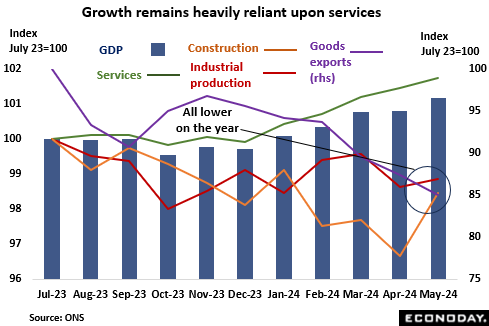

In fact, the real economy appears to have held up quite well last quarter. As of the data for May, second quarter growth was on course for around 0.6 percent which would be only a tick less than its upwardly revised rate at the start of the year. However, in June, retail sales, which have been particularly volatile of late, were barely above from their level in January and the same flat trend applies to manufacturing output. Not helping either, real goods exports have declined every month since January and in May saw their weakest level since the start of 2021. So, for now, growth remains lopsided and heavily dependent on services. Still, most leading indicators point to a modestly positive near-term outlook, notably consumer confidence which, led by a jump in buying intentions, improved for a fourth straight month in July to hit its highest mark since September 2021.

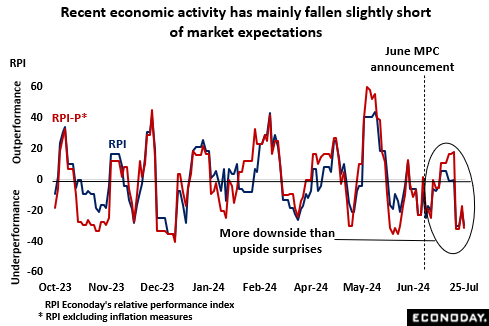

Even so, since the June announcement, overall economic activity has tended to undershoot market expectations. Hence, while there have been both upside and downside surprises, Econoday’s Relative Performance Index (RPI) averaged minus 11 over the period. Excluding inflation indicators (RPI-P), the mean reading was a little firmer but still just sub-zero at minus 6. In other words, recent economic data have played more into the hands of the MPC’s doves than hawks, albeit not by very much.

July’s swearing in of a new labour government with a huge majority makes for an uncertain outlook for fiscal policy and may leave the BoE rather more cautious about the pace of future interest rate cuts. However, for now it seems that the bank is prepared to give Chancellor Rachel Reeves the benefit of the doubt. At least two MPC members (Deputy Governor Dave Ramsden and long-term dove Swati Dhingra) look certain to call for an immediate 25 basis point reduction. Newcomer Clare Lombardelli can be expected to side with Governor Andrew Bailey (who has recently been noticeably quiet on the issue), so should he opt for an ease too, only one more vote would be needed for the doves to achieve a majority. To this end, Chief Economist Huw Pill might well hold the key.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings. The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day.

The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day. Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.

Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.