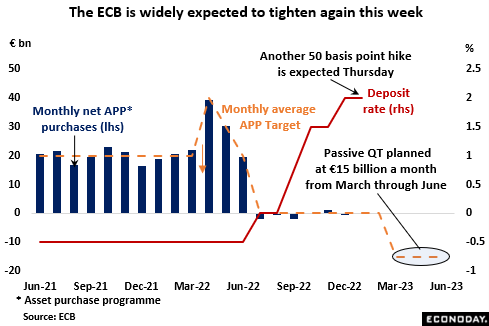

There may be differences over the desired size of any hike, but a concerted raft of hawkish comments from Governing Council (GC) members this month strongly suggests unanimity over the need for higher ECB interest rates on Thursday. The market consensus is for a second successive 50 basis point increase which, if correct, would put the deposit rate at 2.5 percent, the refi rate at 3.0 percent and the rate on the marginal lending facility at 3.25 percent. It would also boost the cumulative tightening since last July to some 300 basis points. Both a smaller, 25 basis point, or larger, 75 basis point increase cannot be ruled out altogether but nether seems particularly likely.

This week’s discussions should also reaffirm that (passive) QT will start in March. At the end of last year, the bank indicated that it would aim to reduce its balance sheet by an average €15 billion each month through the end of the second quarter whereupon it would determine the subsequent pace of shrinkage. However, note that outright asset sales at this stage are not under discussion and the switch to QT only applies to purchases made under the asset purchase programme (APP). As regards the pandemic emergency purchase programme (PEPP), which was terminated last March, full reinvestment is currently still scheduled to remain intact until at least the end of 2024 and this seems likely to remain the case.

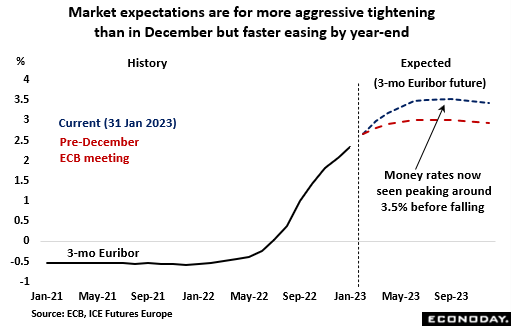

Reflecting the more hawkish tone to ECB rhetoric, market expectations for ECB tightening this year have become notably more aggressive than just before December’s policy announcement. From currently around 2.5 percent, futures now see 3-month money rates peaking at about 3.5 percent in September, up from 3.0 percent previously. However, steeper rate hikes in the first half of the year are also expected to pave the way for a slightly faster pace of easing later. A 25 basis point cut in key rates is now largely priced in by March next year and money rates are predicted to slide to around 2.80 percent by December 2024.

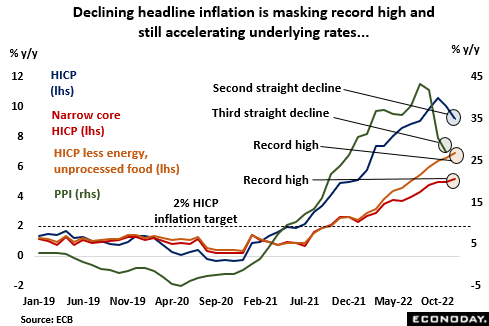

In fact, following a surprisingly sharp fall in inflation in December, the ECB was quick to express its surprise at market talk that the pace of interest rate rises might soon slow and may reiterate that view this week. The deceleration in overall price rises was clearly good news but more important was the continued acceleration in the two main core measures. So, while the headline rate was falling fully 0.9 percentage points to 9.2 percent, a 4-month low, the narrow underlying gauge rose 0.2 percentage points to 5.2 percent and the wider index, which excludes just energy and unprocessed food, a still sharper 0.3 percentage points to 6.9 percent. Both underlying rates were new all-time highs, adding to fears that inflation is becoming increasingly entrenched. The ECB will be fully aware that energy-related base effects are likely to subtract several percentage points off the overall inflation rate in 2023 so developments in the core measures will be all the more significant to policy over coming months.

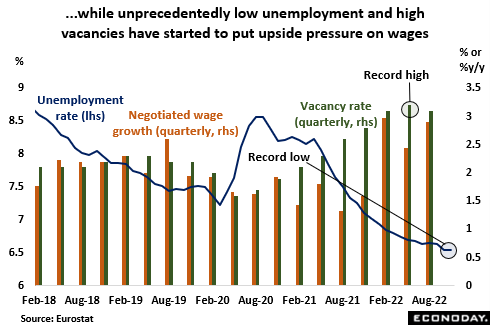

However, even though underlying inflation is still rising, any effect on the wages market has so far been quite limited. Official data from Eurostat are only quarterly and tardy but at 3.1 percent in the third quarter of 2022, annual negotiated wage growth was relatively subdued. This was down from the previous period’s record high, albeit still the second strongest reading to date. An ECB survey last quarter found non-financial companies expecting to raise pay around 4 percent this year, well below the current headline and core inflation rates. Even so, there are upside risks as the labour market is ominously tight. The unemployment rate in November matched October’s record low and third quarter vacancies were only just short of their historic peak. Indeed, the ECB’s experimental wage tracker currently points to a substantial pick-up wage growth over the next few quarters.

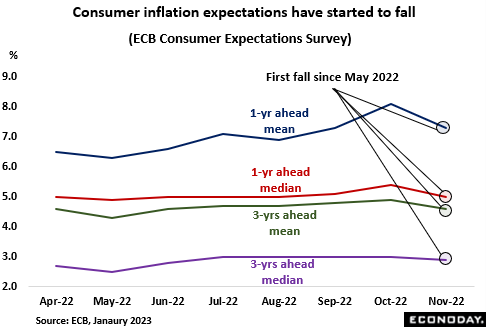

Such risks will become all the more elevated should possible second-round effects of rapidly rising prices not be kept under control and this means inflation expectations must remain anchored. On this front the latest news has been cautiously positive. According to the ECB’s own survey (based on a sample of about 14,000 adults in six of the Eurozone’s biggest countries) median consumer expectations for the next 12 months fell from 5.4 percent in October to 5.0 percent in November and for the next three years dipped a tick to 2.9 percent. Both gauges remain uncomfortably far above the 2 percent HICP target but this was the first decline for each since last May. Moreover, household inflation expectations in the EU Commission’s January report eased for a fourth successive month and now stand below their long-run average.

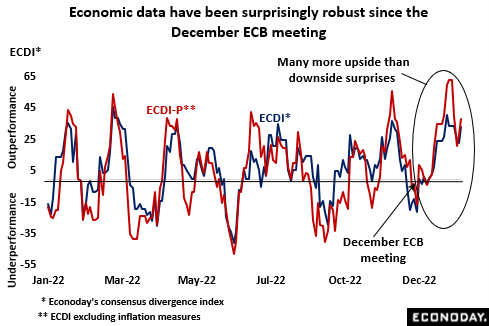

More generally, while clearly slowing, the Eurozone real economy has surprised almost wholly on the upside since the December ECB meeting, notably so in the data released so far this month. Econoday’s consensus divergence index (ECDI), which measures how overall economic activity has been performing versus market expectations, and the ECDI-P, which omits inflation surprises, have been well above zero since early January and were very recently at near-record levels. With fourth quarter GDP eking out a 0.1 percent quarterly rise, such strong readings have led some GC members to dismiss the chances of even a shallow Eurozone recession this year and probably all but rule out a smaller 25 basis point hike on Thursday. However, they certainly help to clear the path for another 50 basis point increase.

Any move in the deposit rate above 2 percent on Thursday would lift ECB policy out of neutral and put it into a restrictive stance. All GC members seem to believe that this is necessary to get inflation back on target and Thursday’s tone is very likely to be hawkish. However, beyond that, there are clearly disagreements over how much higher rates need to go. Consequently, with decision making now being made on a meeting-by-meeting basis, the monthly economic data in general become all the more important and the core inflation indicators particularly so.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings. The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day.

The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day. Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.

Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.