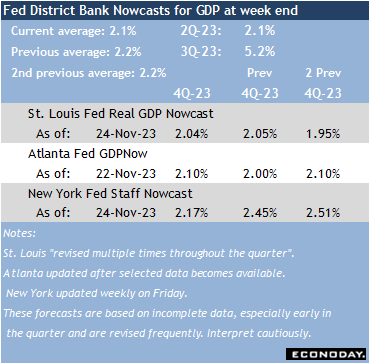

The available data for forecasting GDP growth in the fourth quarter 2023 are still scanty and the outlook could change as more numbers become available. However, the three Fed district bank GDP Nowcasts are surprisingly closely aligned and point to another quarter of moderate expansion for the US economy. If Fed policymakers are anticipating a period of below trend growth as a necessary consequence of restrictive monetary policy put in place to fight inflation, the last quarter of this year does not look like the start of it.

As of the end of the November 24 week, the St. Louis Fed’s Real GDP Nowcast is 2.04 percent expansion, the Atlanta Fed’s GDPNow estimate is 2.10 percent growth, and the New York Fed’s Staff Nowcast is up 2.17 percent. The forecasts have seen little revision over the past few weeks. Historically, the Atlanta Fed has the best correlation (0.980) with the advance estimate of GDP, while the St. Louis Fed’s estimate tends to run low and has only a modest correlation (0.753). The New York Fed’s series recently underwent a major methodological change and there isn’t enough history to make a good performance comparison.

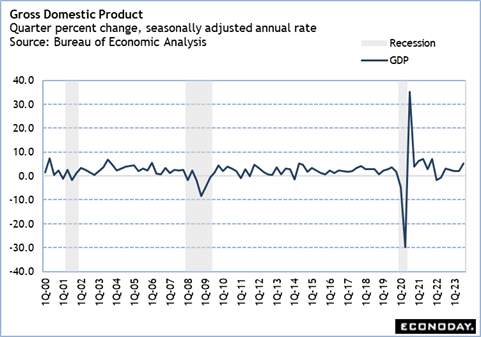

The average of the three forecasts is for GDP to increase 2.1 percent in the fourth quarter. The FOMC’s longer-run forecast for GDP is up 1.8 percent. Fed policymakers haven’t seen a below-trend quarter since down 0.6 percent in the second quarter 2022 right around the time the FOMC began rapidly raising rates to a restrictive level. The US appears to be weathering the rapid increases in rates without broad harm to the economy. Of course, the actual fourth quarter GDP will not be known until the advance estimate is released at 8:30 ET on Thursday, January 25, 2024.

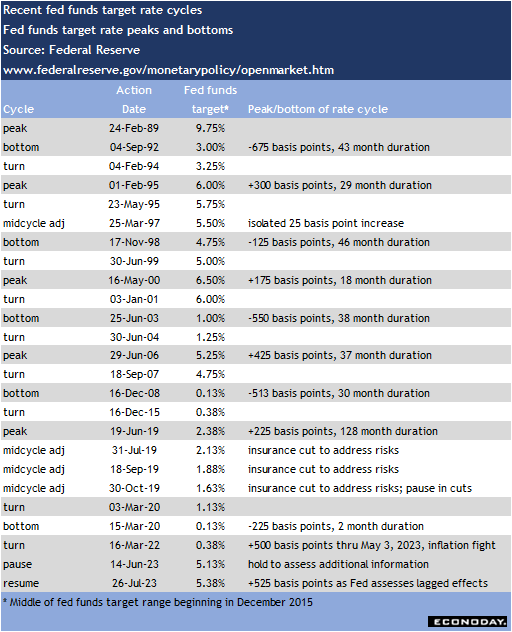

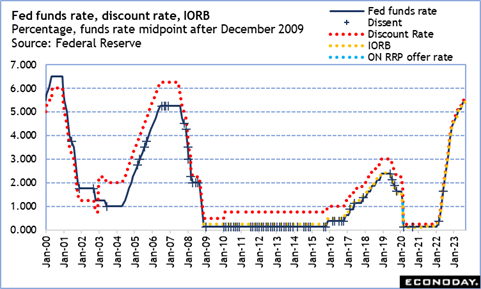

When the FOMC next meets on December 12-13 the deliberations will include the next update to the summary of economic projections (SEP). While 2023 seems to be finishing much as expected in the prior SEP, what will be critical is how FOMC participants revise – or not – the forecasts for 2024 and 2025. The change in real GDP forecasts for 2024 and 2025 were 1.5 percent and 1.8 percent, respectively, in the September SEP. It will be interesting to see if the median forecast is revised – and if so, in which direction – when the next SEP is set for 14:00 ET on Wednesday, December 13. While few policymakers are saying it outright, so far restrictive monetary policy has managed to see progress in disinflation without materially damaging the labor market to edge toward the best of all possible outcomes in the fight against inflation – a cooling of the economy without a recession.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings. The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day.

The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day. Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.

Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.