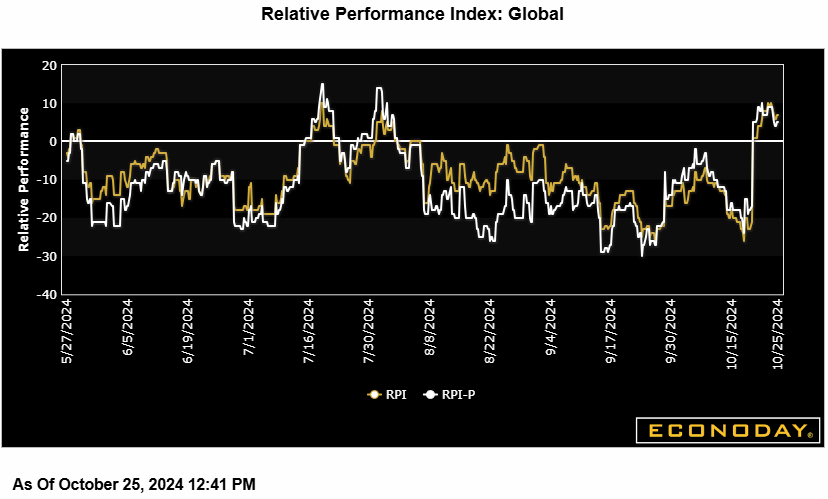

Moderate outperformance by the U.S. was mainly responsible for Econoday’s global Relative Economic Performance Index (RPI) holding in positive surprise territory (7) last week. Economic activity in China, the Eurozone, Japan and Switzerland is now largely moving in line with market expectations while the UK disappoints.

In the U.S., economic activity continues to outperform forecasts as it has for much of the period since early September. The RPI and RPI-P both closed out the week at 16. More of the same would further dent speculation about another cut in interest rates by the Federal Reserve in November.

In Canada, the RPI (minus 13) and RPI-P (minus 4) fell back below zero providing additional justification for the Bank of Canada’s 50 basis point cut in key interest rates. Without stronger growth and/or inflation, a further ease of at least 25 basis points is on the cards for December.

In the Eurozone, the combination of sluggish growth and surprisingly low inflation would seem to make another cut in ECB interest rates in December a done deal. At 5 and exactly zero respectively, the region’s RPI and RPI-P show economic activity in general meeting subdued growth expectations accompanied by falling inflation. A downside surprise on Thursday’s flash October HICP report would simply bolster speculation about a full 50 basis point ease.

In the UK, the signs of a sharper than anticipated slowdown in economic activity at the start of the current quarter saw the RPI decline to minus 20. The real economy is largely matching expectations – the RPI-P stands at 2 – but the recent surprisingly steep slowdown in inflation makes a November cut in Bank Rate very likely.

In Switzerland, a blank data calendar left the RPI at exactly zero and the RPI-P at 25. Ongoing disinflationary signals remain strong enough to sustain speculation about what would be a fourth consecutive cut in the Swiss National Bank’s policy rate in December.

In Japan, the RPI (9) slipped temporarily below zero before closing out the week back in positive surprise territory on the back of a surprisingly firm inflation update. No change in policy is expected at this week’s Bank of Japan announcement.

There were no important data released in China. However, with the RPI and RPI-P (currently both 7) showing a clear downside bias in recent months, the national central bank’s 25 basis point cut in key lending rates at the start of the week was always going to be just a matter of time.

Econoday’s RPI provides a handy summary measure of how an economy has recently been evolving relative to market expectations.

A reading above zero means that the economy in general has been performing more strongly than expected and vice versa for a reading below zero. The closer is the value to the maximum (+100) or minimum (-100) levels, the greater is the degree to which markets have been under- or over-estimating economic activity. A zero outturn would imply that, on average, the market consensus has been correct. Note too that the index is sensitized to place extra weight upon those indicators that investors consider to be the most important.