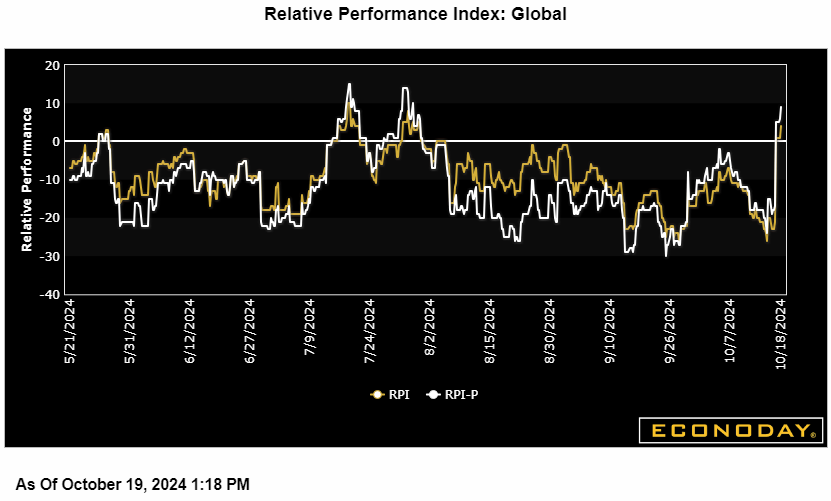

For the first time since early August and mainly due upside surprises out of China, Econoday’s Relative Economic Performance Index (RPI) last week climbed back above zero. However, at just 4, the index only shows recent global economic activity broadly matching market forecasts.

In the U.S., the latest data signal overall economic activity modestly outpacing expectations. The RPI ended the week at 10 and the RPI-P at 19. Both gauges have been almost solely in positive surprise territory since early September, making another 50 basis point cut by the Federal Reserve in November unlikely.

In Canada, surprising strength in housing and the manufacturing sector lifted the RPI to 1, to all intents and purposes indicating that recent economic activity in general was running in line with forecasts. Excluding inflation indicators, the RPI-P (13) shows limited outperformance but it is the weakness of prices that has left investors confident that the Bank of Canada will cut interest rates by at least a further 25 basis points on Wednesday.

In the Eurozone, recent data have fairly consistently undershot already soft market forecasts meaning that last week’s 25 basis point cut by the European Central Bank came as no surprise to anyone. Closing out the period at minus 9 and exactly zero respectively, the RPI and RPI-P suggest that a third successive ease in December is very possible.

In the UK, the latest data trimmed the RPI to minus 5 but nudged the RPI-P a notch higher to 23 – the difference between the two reflecting a surprisingly weak inflation picture. As such, the gap increases the chances of Bank Rate being cut again next month, especially after what will be a tight Budget on 30 October.

In Switzerland, further unexpectedly strong disinflationary signals in manufacturing similarly saw the gap between the RPI (zero) and RPI-P (25) widen significantly. Real economic activity has been running slightly ahead of forecasts since the end of August but, with price pressures in general so weak, investors continue to anticipate another cut in the Swiss National Bank’s policy rate in December.

In Japan, the RPI (23) and RPI-P (8) both slipped temporarily below zero before closing out the week back in positive surprise territory on the back of a surprisingly firm inflation update. Investors remain uncertain about the timing of the next Bank of Japan tightening but the upcoming wage round will clearly be a key factor.

On balance, last week’s stream of Chinese data was on the strong side of expectations and firm enough to lift the RPI and RPI-P (both 7) above zero for the first time since late July. Even so, with economic growth the slowest since early 2023 and house price deflation the steepest since May 2015, the data still underline the need for the recently announced monetary and fiscal stimulus packages.

Econoday’s RPI provides a handy summary measure of how an economy has recently been evolving relative to market expectations.

A reading above zero means that the economy in general has been performing more strongly than expected and vice versa for a reading below zero. The closer is the value to the maximum (+100) or minimum (-100) levels, the greater is the degree to which markets have been under- or over-estimating economic activity. A zero outturn would imply that, on average, the market consensus has been correct. Note too that the index is sensitized to place extra weight upon those indicators that investors consider to be the most important.