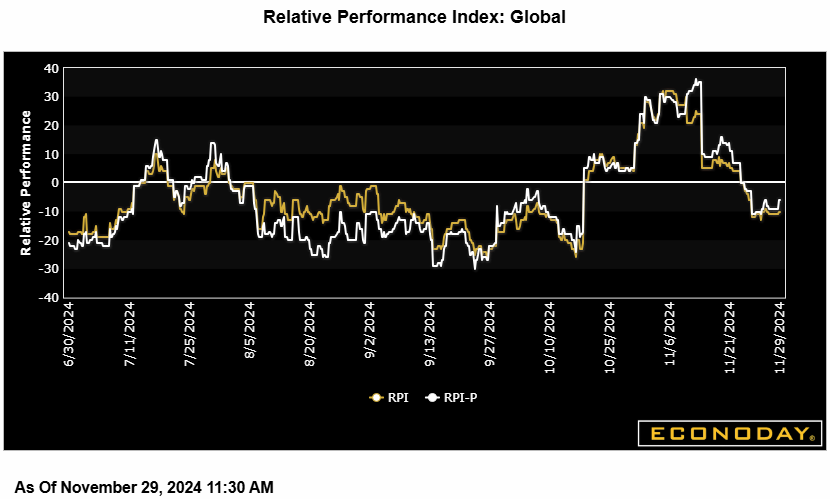

Econoday’s Relative Economic Performance Index (RPI) lost some ground last week and, at minus 10, shows recent global activity running a little cooler than expected. The dip mainly reflects a switch to modest downside surprises in the U.S. data but the Eurozone, UK and Japan are also underperforming by varying degrees. China is still matching forecasts while Canada has edged slightly ahead.

In the U.S., a very mixed period for economic news was, on balance, soft enough to trim the RPI to minus 6 and the RPI-P to minus 8. However, neither reading is far enough below zero to signal any meaningful shortfall in activity versus forecasts and importantly, core PCE inflation matched the consensus. Accordingly, most investors still see the Federal Reserve easing by a further 25 basis points later this month.

In Canada, third quarter GDP growth was sluggish but in line with the market call. This left both the RPI (8) and RPI-P (1) unchanged on the week, signalling overall economic activity just marginally firmer than expected. The Bank of Canada is widely seen cutting key interest rates next week.

In the Eurozone, further signs of surprisingly poor growth this quarter contrasted with a much as forecast pick-up in inflation to leave the region’s RPI at minus 23 and the RPI-P at minus 18. The persistent weakness of the real economy continues to call for another cut in ECB interest rates next week but the stickiness of prices also argues against anything more than 25 basis points.

In the UK, the RPI (minus 25) and RPI-P (minus 35) were little changed over the week and so still point to unexpectedly soft economic activity in general. October’s surprisingly firm inflation report has probably ruled out a reduction in Bank Rate this month but any decision to keep policy on hold is likely to mask a split vote.

In Switzerland, economic news was more upbeat than anticipated and firm enough to lift the RPI-P to exactly zero. Even so, at minus 7, the RPI-P shows recent inflation surprises have remained on the downside and with goods exports slumping last quarter, the Swiss National Bank will be all the more worried about the high level of the Swiss franc. At least a 25 basis point cut in the policy rate next week seems a done deal.

In Japan, downside shocks on output and demand more than offset surprisingly firm Tokyo inflation to drag down the RPI to minus 36 and the RPI-P to a lowly minus 65. However, with investors focussed on inflation, it is the jump here that has given a fresh boost to speculation about another hike in Bank of Japan interest rates next week.

In China, another largely blank data calendar for key indicators made for no change in either the RPI (zero) or the RPI-P (20).

Econoday’s RPI provides a handy summary measure of how an economy has recently been evolving relative to market expectations.

A reading above zero means that the economy in general has been performing more strongly than expected and vice versa for a reading below zero. The closer is the value to the maximum (+100) or minimum (-100) levels, the greater is the degree to which markets have been under- or over-estimating economic activity. A zero outturn would imply that, on average, the market consensus has been correct. Note too that the index is sensitized to place extra weight upon those indicators that investors consider to be the most important.