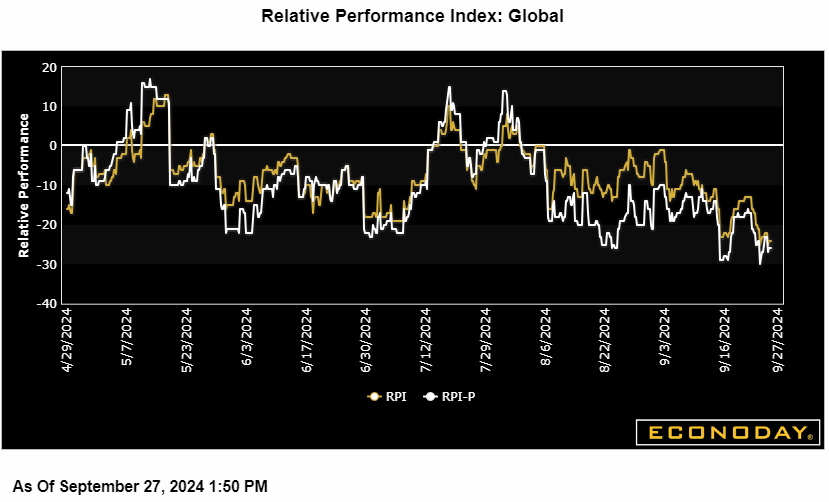

Closing the week at minus 22, Econoday’s Relative Economic Performance Index (RPI) shows global economic activity continuing to fall somewhat short of market expectations. This is particularly true of China, where policy was eased significantly last week, and the Eurozone, where pressure for further interest rate cuts is steadily building. However, the U.S. is still running a little hotter than generally expected.

In contrast to many countries, the U.S. RPI (13) and RPI-P (18) show economic activity on balance still beating market forecasts. Another Fed cut is widely anticipated in November but sustained positive readings here would bolster the chances on only a 25 basis point move.

In Canada, slightly stronger than expected GDP in July was enough to boost the RPI-P back above zero, but, at 3, only just. The RPI (minus 10) remains in negative surprise territory and another Bank of Canada ease is still widely forecast next month. The main question now mainly concerns the size of the move.

In the Eurozone, the recent mixed pattern to the data continued, albeit still with a downside bias versus market expectations. Indeed, at minus 25 and minus 29 respectively, the region’s RPI and RPI-P remain sub-zero, helping to underpin speculation about another cut in ECB interest rates as soon as next month. To this end, Tuesday’s flash September HICP report will be key.

In the UK, recent data have similarly struggled to keep up with market forecasts. However, with the RPI ending the week at 1 and RPI-P at minus 4, the signs are overall economic activity is now performing broadly in line with relatively robust expectations. The timing of the next cut in Bank Rate remains uncertain.

In Switzerland, an absence of any fresh economic data left both the RPI (14) and RPI-P (25) in positive surprise territory. However, with both gauges mainly sub-zero since the Swiss National Bank’s June policy announcement, what was a third successive 25 basis point interest rate cut by the central bank on Thursday was widely anticipated. There could be more to come.

In Japan, there were no surprises in Tokyo’s leading indicator of nationwide CPI inflation. However, recent data have been firm enough to boost the RPI to minus 1 and the RPI-P to 16, the latter’s strongest mark since mid-August. The BoJ still looks set to raise interest rates again so long as future inflation meets its expectations. December seems to be the most favoured month for forecasters.

In China, the unbroken run of sub-zero RPI and RPI-P readings since the start of August has steadily added to doubts about the government’s chances of meeting its 5 percent growth target this year. At currently minus 64 and minus 70 respectively, both gauges remain deep in negative surprise territory. Indeed, their persistent weakness was acknowledged by the authorities last week via the announcement of sizeable new, if overdue, monetary and fiscal policy stimulus.

Econoday’s RPI provides a handy summary measure of how an economy has recently been evolving relative to market expectations.

A reading above zero means that the economy in general has been performing more strongly than expected and vice versa for a reading below zero. The closer is the value to the maximum (+100) or minimum (-100) levels, the greater is the degree to which markets have been under- or over-estimating economic activity. A zero outturn would imply that, on average, the market consensus has been correct. Note too that the index is sensitized to place extra weight upon those indicators that investors consider to be the most important.