The December 9 week does not have a busy data schedule, but it does include the November CPI report at 8:30 ET on Wednesday. This is one of the last reports that could mean an adjustment to the outlook for the outcome of the FOMC meeting on December 17-18 and the content of the quarterly summary of economic projections (SEP). The last significant one will be the retail sales numbers for November at 8:30 ET on Tuesday, December 17.

In any case, the coming week is firmly within the communications blackout period around the FOMC meeting (midnight, December 7 through midnight, December 19). There will be no public comments from Fed officials that could influence market expectations for the FOMC meeting. The numbers will have to do the talking in the context of prior public remarks.

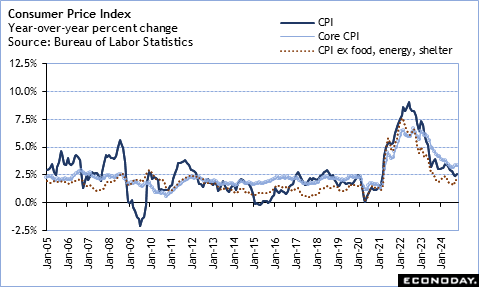

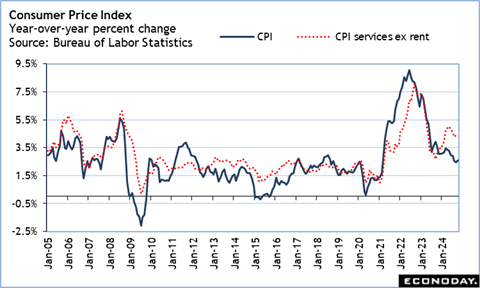

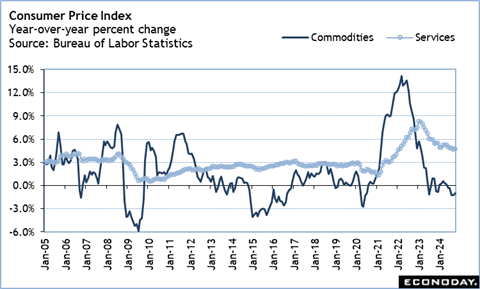

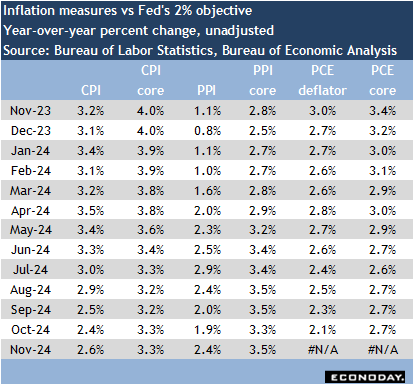

The October CPI data pointed to a stall in the pace of disinflation at both the all-items and core levels. In October, the CPI was up 2.6 percent year-over-year compared to up 2.4 percent in September. The core CPI was up 3.3 percent, the same as the prior month’s annual pace. Food prices were up 2.1 percent compared to October 2023 while energy costs were down 4.9 percent. Underlying inflation continued to run above the Fed’s 2 percent objective for several important categories. Most notably it was to be seen in shelter costs which are up 4.9 percent year-over-year in October, the same as in September. But inflation was also sharp for things like insurance, medical care, and tuition which add up in household budgets. Non-housing services inflation remains a problem in getting inflation sustainably under control.

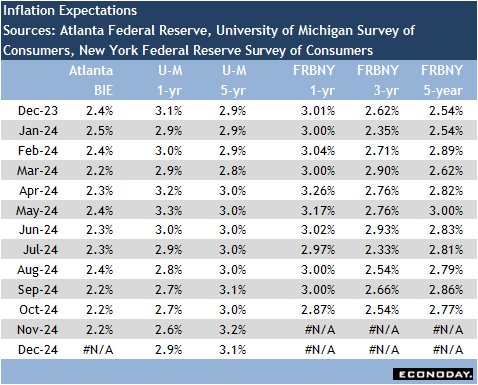

If the November CPI reveals a plateau in disinflation for consumers, it raises the possibility that the expected 25 basis point rate cut on December 18 at 14:00 ET might not materialize. Even if the FOMC does cut the fed funds target rate range, it would likely mean that the speed of future rate cuts would slow with fewer forecast for 2025 and into 2026. The most recent data on inflation expectations suggests that consumers are not expecting much more improvement in inflation in the near-to-medium terms, although expectations remain anchored.

The FOMC will have reassurance that the maximum employment side of the dual mandate is not suffering under restrictive monetary policy while it continues to address price stability.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings. The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day.

The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day. Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.

Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.