None of the economic data on the calendar for the July 24 week will garner nearly as much attention as the FOMC meeting on Tuesday and Wednesday. In spite of widespread anticipation of a 25 basis point increase in the fed funds target range to 5.25-5.50 percent, this is by no means a done deal. While Fed policymakers have been explicit that the fight against too high inflation is not over, they have also been clear that they are watching the economic data closely. Policymakers do acknowledge that headline inflation has cooled meaningfully, but pivotal to the deliberations will be the ill-defined effects from the “long and variable lags” of prior rate hikes.

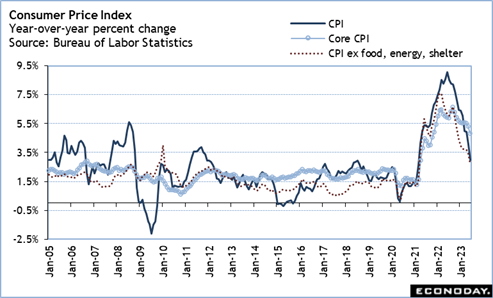

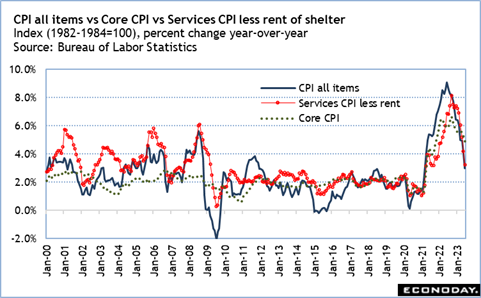

The FOMC won’t see the June data on their preferred measure of inflation until after the meeting. The report on personal income and spending includes the PCE deflator but won’t be released until 8:30 ET on Friday. However, June data showed the all-items CPI up 3.0 percent year-over-year, a sharp drop from 4.0 percent in May. The core CPI in June rose 4.8 percent compared to 5.3 percent in May. The CPI excluding food, energy, and shelter was up 2.7 percent from June 2022 compared to 3.4 percent year-over-year in May. The CPI report has a special aggregate for all services excluding rent that indicates prices for consumer services are relenting. This year-over-year pace in June slowed to 3.2 from 4.2 percent.

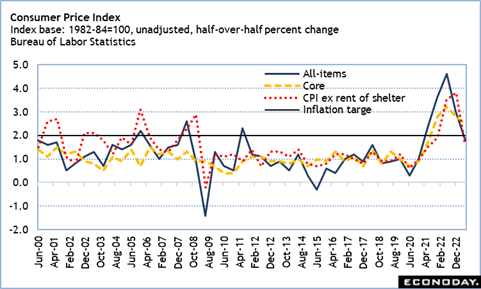

However, the pace of declines in inflation may have accelerated even more than the year-over-year measures suggest. If we look at the half-over-half percent changes in the all-items CPI compared to the Fed’s flexible average inflation target of 2.0 percent, the CPI is at up 1.8 percent in June compared to 3.0 percent in December and the near-term peak of 4.6 percent in June 2022. The core CPI is coming down less quickly, but it is nearing target at 2.5 percent in June 2023 compared to 2.8 percent in December 2022 and near-term peak of 3.2 percent in June 2022. Moreover, the CPI for services excluding rent is at 1.6 percent in June 2023 compared to its near-term peaks of 3.8 percent in December 2022 and 3.5 percent in June 2022.

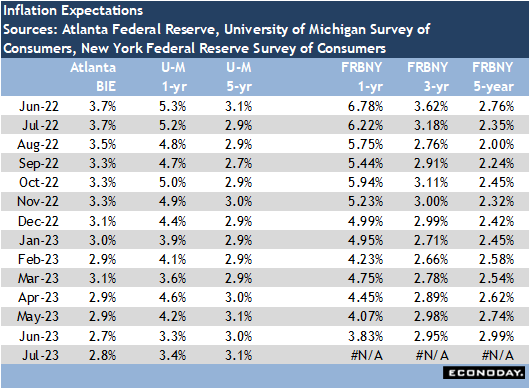

If the FOMC determines that the inflation data are moving along its expected path and will continue to do so, it may not find another hike necessary at this time. It will not declare the war on inflation as won, especially with uncertainties in the geopolitical climate that would well drive food and energy prices higher again. With inflation expectations well-anchored, the labor market rebalancing, and a resilient US economy likely posting mild expansion in the second quarter 2022, the FOMC may find reason to extend the pause in rate hikes until the September 19-20 meeting. It will be then that the FOMC updates its forecasts and the outlook may be clearer.

Whether the FOMC lifts the fed funds rate at this meeting or not, Chair Jerome Powell’s message at his 14:30 Wednesday press briefing will remain that the job on checking inflation is not done and that the FOMC remains on a meeting-to-meeting basis for monetary policy.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings. The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day.

The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day. Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.

Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.