Note: The following was written before the news of the failure of Silicon Valley Bank (SVB). This is the sort of exogenous event that throws the near-term outlook for monetary policy into uncertainty. The question is whether this is an isolated incident or one which represents systemic risk. The proximity to the FOMC meeting on March 21-22 means that Fed policymakers will face greater difficulty in judging whether financial conditions can take another rate hike, and if so how much. They will have to do so against the backdrop of economic data that were compiled before the collapse of Silicon Valley Bank and Signature Bank; these data show a strong labor market, persistent inflation pressures and solid consumer spending. Whatever it elects to do on rate – pause, 25 basis points, or 50 basis points – Fed policymakers are going to face harsh criticism and doubts about its ability to guide the economy amid the consequences of pandemic-era stimulus.

Fed policymakers will be out of the public eye during the communications blackout period around the March 21-22 FOMC meeting. It goes into effect as of midnight on Saturday, March 11 and runs through midnight on Thursday, March 23. Chair Jerome Powell sounded quite hawkish in his semiannual monetary policy testimony on March 7-8, but with the caveat that no decision has yet been made and that policy will be determined by the totality of information available to the FOMC at the meeting.

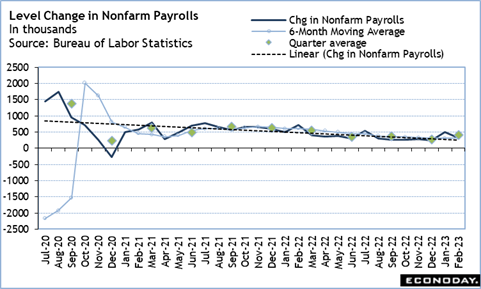

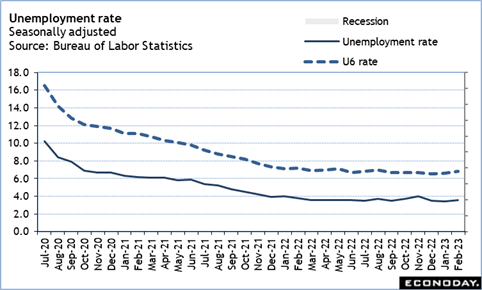

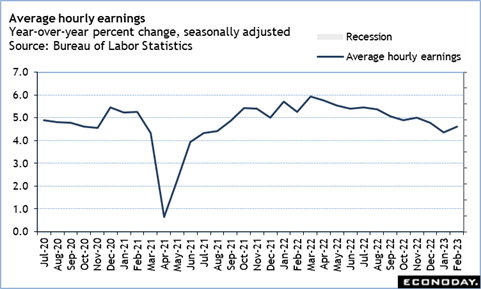

This will include the monthly employment data released on March 10 which showed strong job gains continued into February, modest increases in average hourly earnings, and a small increase in the unemployment rate. There was nothing in the employment situation for February that would counsel the FOMC to pause on rate hikes and enough that it could argue for 50 basis points rather than 25 basis points.

In the March 13 week, the last two economic data reports likely to sway the FOMC decision will be released.

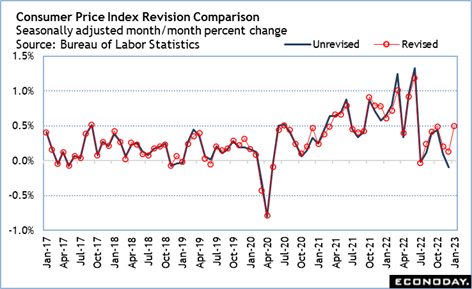

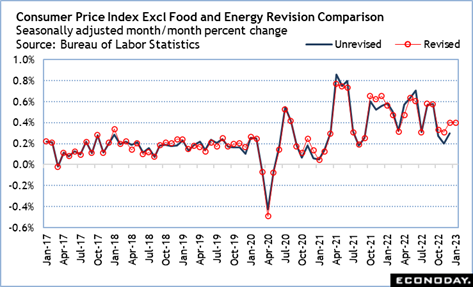

First will be the February consumer price index (CPI) at 8:30 ET on Tuesday. As seen in the annual revisions for the years 2017-2022 and the January 2023 report, the CPI was running higher than previously thought and up from the prior month. There may be some sign of price relief for the February all-items CPI, and perhaps even the CPI excluding food and energy. However, if CPI core services excluding housing is not also improving, the FOMC will have another reason to hike rates by 50 basis points at the March meeting. If some of the lagged effects of past rate hikes are visible, the FOMC may lean more toward a 25 basis point increase.

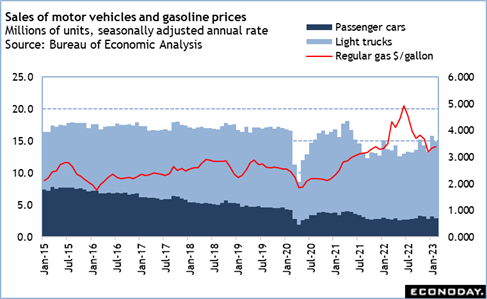

Second is the February report on retail and food services sales at 8:30 ET on Wednesday. Sales of motor vehicles were down in February from January, but still solid. Gasoline prices declined steadily in February, so the dollar value of spending at service stations will depend on whether the volume made up some of the difference. Consumers began to receive their tax refunds in February, so some of that money may have gone back into spending, especially for bigger items. There was a short-live upswing in homebuying in January that may contribute to spending on some household items. A major winter storm could have hit spending, but also encouraged consumers to buy some of the cold weather items still on shelves and some emergency supplies. A few parts of the US experienced record warm temperatures, which may have sent consumers out for gardening and home repair items. If the report is to the upside, the FOMC will have more confidence in the ability of the economy to withstand higher rates. If to the downside, it could be enough to counsel a smaller rate hike.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings. The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day.

The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day. Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.

Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.