Although there are plenty of reports on the economic data calendar in the September 23 week, none is likely to be a standout after the FOMC announced a rate cut of 50 basis points on September 18 to bring the fed funds target rate range down to 4.75 to 5.00 percent. Data related to the housing market, consumer confidence, and manufacturing will all have been compiled before the announcement. The impact of lower rates will deliver a boost to the economy that won’t be visible in the reports until next month.

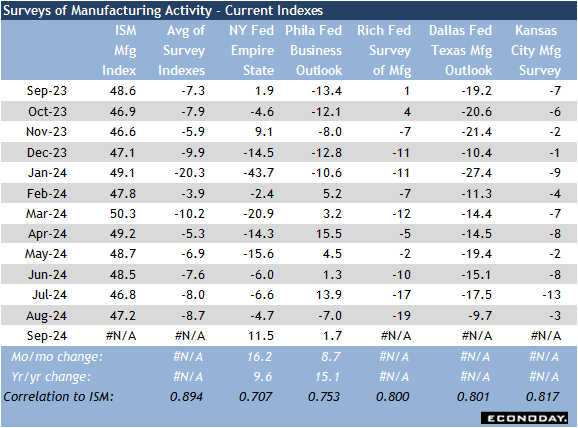

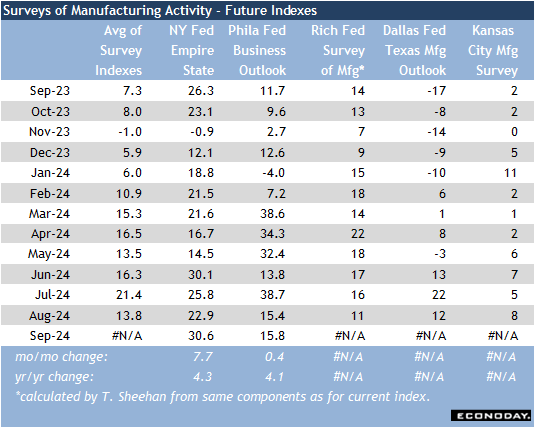

What may prove most interesting in the week – since it will reflect the more recent state of the economy – is the next surveys of manufacturing for September. The surveys for September from the New York and Philadelphia Feds both show a turnaround in the general business conditions indexes to positive territory. The New York index was up 16.2 points to 11.5 after six straight months of contraction. The Philadelphia index rose 8.7 points to 1.7, returning the index to expansion after plunging 20.9 points to -7.0 in August. Neither general business conditions index has the strongest correlation with the ISM Manufacturing Index (New York 0.707, Philadelphia 0.753), so may not be the best hint as to what is happening at the national level for September.

On the other hand, the composite indexes from Richmond and Kansas City – as opposed to the diffusion indexes from the other Fed district bank surveys – have solid correlations with the ISM measure at 0.800 and 0.817, respectively. The Richmond manufacturing index is set for release at 10:00 ET on Tuesday and the Kansas City manufacturing composite index is at 11:30 ET on Thursday. If the Richmond manufacturing index breaks away from the string of negative readings of November 2023 through August 2024, or at least improves from the near-term bottom of minus 19 in August, it will add to the brighter outlook for the factory sector. The Kansas City index hasn’t seen a positive reading since September 2022. If it gets a lift from the minus 3 in September, it will further broaden the outlook for the recession in the factory sector nearing an end.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings. The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day.

The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day. Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.

Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.