The BoE’s May MPC meeting saw Deputy Governor Dave Ramsden join long-term dove Swati Dhingra in calling for an immediate 25 basis point cut in interest rates. The other seven members all again opted for no change. Approaching this month’s meeting, there has been a further, but less than wholly convincing, decline in inflation, while wages have remained stubbornly robust. Consequently, with the real economy having moved out of recession, the overall mix has left speculators expecting no change in Bank Rate and the first cut to be deferred until at least the first meeting after the summer break in August.

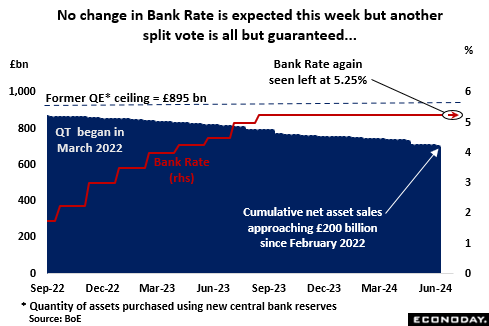

With regard to QT, BoE Governor Andrew Bailey reiterated last month that asset sales would continue even as interest rates fall. The current programme announced last September aims to reduce the stock of gilts held in the Asset Purchase Facility (APF) by £100 billion to £658 billion over the year to October 2024 and remains well on track. As of the start of June, net disposals had shrunk outstandings to slightly below £700 billion, implying a fall in total QE assets of almost £200 billion from their peak level in the first quarter of 2022.

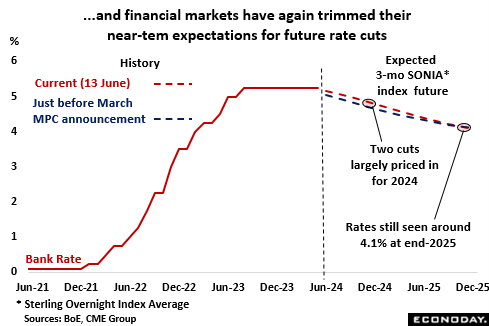

As it is, financial markets have slightly further downgraded their expectations for interest rate reductions since the May meeting. Two 25 basis point cuts are almost fully priced in by year-end but, at around 4.8 percent in December, 3-month money rates are now put 10 basis points higher than previously anticipated. However, medium-term expectations are essentially unchanged with rates still seen ending 2025 at about 4.10 percent.

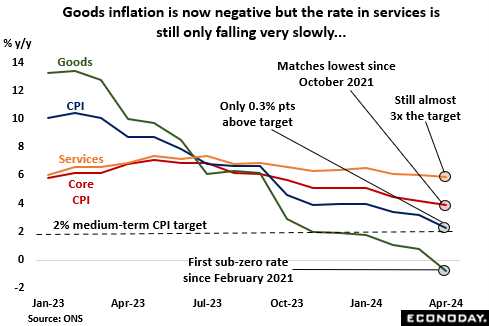

The May inflation update is due Wednesday and will, inevitably, have a big say in how the MPC votes this week. However, the April report was only mixed. A 12 percent cut in the cap on unit energy prices all but guaranteed a sharp fall in the headline rate and, at 2.3 percent, it now stands just 0.3 percentage points above the target level. However, core inflation remains high at 3.9 percent and, most ominously, at some 5.9 percent the rate in services is still almost three times the target. Indeed, inflation here is only 1.5 percentage points below the 32-year peak seen in July 2023. The May report due Wednesday should see the overall rate fall again (possibly below 2 percent) but current readings are unlikely to convince many MPC members that attainment of the 2 percent mark would be sustainable should Bank Rate be cut now.

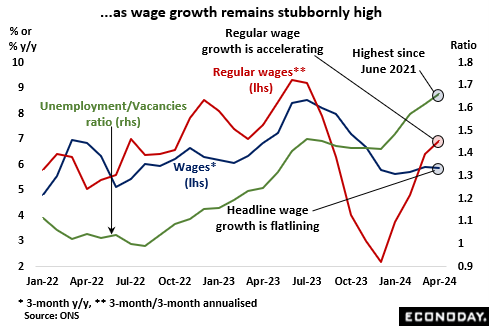

If the ONS data are to believed – and the bank still has serious reservations – the labour market is cooling. Indeed, the unemployment/vacancy ratio is at its highest level in nearly three years. However, wage growth remains an issue. Overall average weekly earnings were still expanding at a 5.9 percent annual rate in the three months to April, unchanged from their first quarter pace and up from 5.6 percent at the start of the year. Regular earnings were even higher at 6.0 percent and, looking at the bank’s preferred annualised quarterly measure, at fully 6.9 percent. At best the underlying trend would appear to be flat and, if anything, accelerating. The MPC still seems to believe that wage pressures are easing but if so, they doing so only very slowly. Current rates continue to pose a serious threat to keeping inflation at 2 percent over the medium-term.

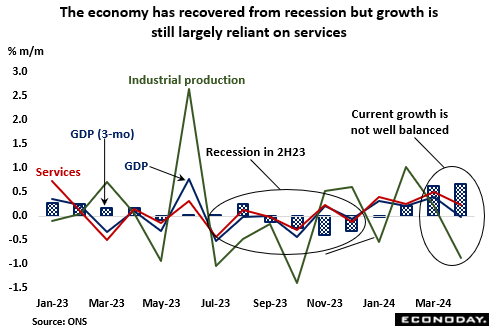

More generally, the real economy has moved out of the mild recession seen in the second half of last year. By April, the 3-monthy GDP growth rate had picked up from minus 0.3 percent at the end of 2023 to 0.7 percent, matching its strongest post since March 2022. However, with industrial production at a 3-month low and construction having fallen every month since January, the recovery has been poorly balanced and largely reliant on services. Still, more up to date surveys suggest that the two weaker sectors are on the turn and rising consumer confidence, which hit its highest level in nearly two-and-a-half years in May, should help to underpin the upswing in services. Exports remain soft but should not prevent GDP growth maintaining a modest profile over the rest of the year.

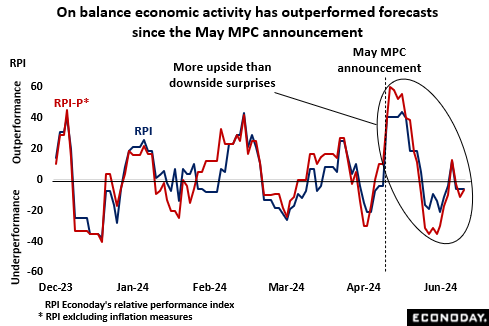

In fact, economic activity in general has slightly outperformed market forecasts since the May MPC meeting. Upside surprises have beaten downside shocks to the extent that Econoday’s Relative Performance Index (RPI) averaged 9. Excluding inflation indicators (RPI-P), the mean reading was just 1 point lower at 8. Neither value is far enough above zero to indicate major net forecast errors but the bias at least helps to reduce pressure for an early cut in Bank Rate.

Prior to the release of the April inflation data, speculators were much more split over a cut in Bank Rate this month. Now, it will take a very weak May CPI to reignite any real thoughts about an ease as soon as Thursday. Realistically, a 6-3 split on the MPC in favour of no change is probably about the most dovish possible outcome. The bottom line is that while underlying inflation has fallen markedly from its 7.1 percent peak last May, it still has a long way to go to make most policymakers happy.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings. The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day.

The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day. Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.

Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.