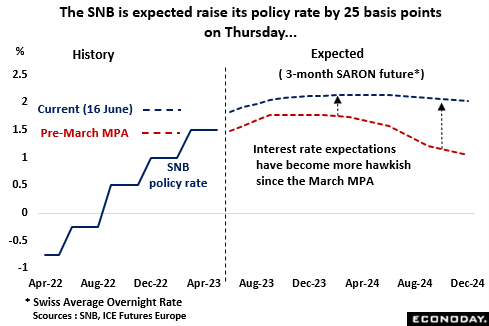

Having previously delivered a 50 basis point hike at the March Monetary Policy Assessment (MPA), the SNB is widely expected to raise its policy rate again on Thursday. The last change lifted the benchmark rate to 1.50 percent, its fourth successive increase since the first back in June 2022, and, in the face of what was then a possible full-blown banking crisis, a move that underlined the central bank’s determination to get inflation back under control. The rise boosted the cumulative tightening to 225 basis points but, even then, the bank’s updated forecast still showed inflation at or above 2 percent throughout the projection horizon. The consensus for the June MPA is a smaller 25 basis points, reflecting a recent loss of economic momentum, lingering worries about the stability of the banking system and, crucially, a fall in inflation.

Interest rate expectations in financial markets have become a good deal more hawkish since the March MPA. Even so, rates are still not expected to rise as far as anticipated just before that month’s global banking turmoil. Lingering concerns about the possible fallout from this have helped to cap the expected peak to 3-month money rates at currently around 2.1 percent. This compares with the near-2.5 percent level priced in just before the collapse of Silicon Valley Bank (SVB). In addition, the pace of prospective SNB easing has been cut significantly and even by the end of 2024, rates are still seen only a few basis points below 2 percent.

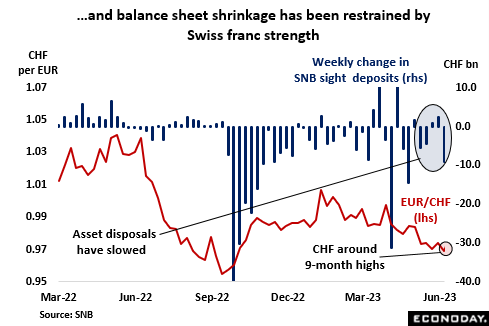

Another factor probably weighing on interest rate expectations is the local currency. The Swiss franc has received strong capital inflows in recent months and current levels against the euro and dollar are amongst the strongest seen outside of the period immediately following the abandonment of the €1.20 target floor in January 2015. The SNB is known to favour a stable franc and will no doubt on Thursday reiterate its willingness to intervene on either side of the market as necessary to achieve this goal. To be sure, another 50 basis point hike now could cause the unit to climb sharply higher. As it is, the pace of balance sheet reduction seems to have slowed in respect of the bank’s concerns that too rapid a rate of asset sales might add to the franc strength.

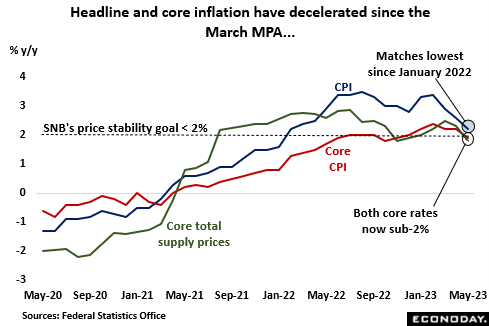

In any event, recent inflation developments have clearly reduced some of the pressure to tighten further. Headline inflation last month was just 2.2 percent, still a little above where the monetary officials would like it to be but matching its lowest mark since January 2022 and more than a full percentage point short of the 3.5 percent peak seen in August 2022. Importantly too, core inflation dipped back below the 2 percent mark for the first time since last November. Pipeline pressures in manufacturing have also eased. The total supply price inflation rate declined to minus 0.3 percent in May, its first sub-zero print since March 2021 and within which the core rate fell to just 1.8 percent, matching its weakest reading since July 2021. The SNB will want to feel confident that the improvement is sustainable but it must be cautiously optimistic about the latest trends. However, all that said, it will also be fully aware that without some additional slack in the labour market, any pick-up in demand could quickly translate into higher wages and prices.

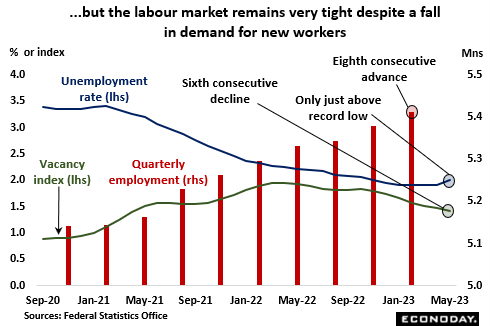

To this end, labour market vacancies have been declining for a while now but they remain more than 50 percent above their level just before Covid. Employment growth remains robust and, at 2.0 percent, the jobless rate in May was just a tick above its record low. In other words, overall conditions remain extremely tight, a point that will no doubt be highlighted in the central bank’s MPA.

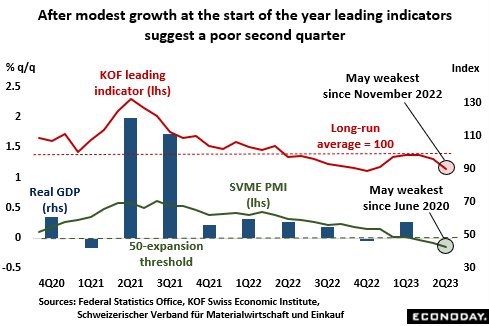

At a quarterly 0.3 percent rate, real GDP growth was surprisingly firm at the start of the year. A release of pent-up demand in the household sector caused by earlier Covid restrictions and a jump in investment in equipment and software were largely responsible. However, spending on goods remains soft and the current quarter got off to a particularly poor start with retail sales volumes dropping a full 2.0 percent on the month. Consumer confidence is also still way below its historic norm. Moreover, leading indicators have deteriorated quite sharply in recent months. The SVME manufacturing PMI sunk to just 43.2 in May, its worst print in almost three years and deep in recession territory. At the same time, the KOF’s forward-looking barometer posted both its steepest fall in a year and its weakest mark in six months. The new forecast released by the State Secretariat for Economic Affairs (SECO) last week put 2023 growth at just 1.1 percent and saw inflation falling to only 1.5 percent in 2024.

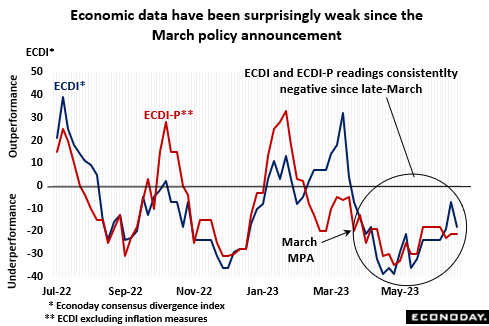

In fact, in general economic news has been notably weaker than expected since the last MPA. Econoday’s Consensus Divergence Index (ECDI), which measures overall economic activity versus the market consensus, has not been in positive surprise territory since late-March and the latest readings continue to show overall economic activity lagging well behind forecasts. This may not be enough to prevent the policy rate going up again this week but it may well be reflected in a downgrading of the central bank’s economic forecasts. If so, this could help to limit the extent to which interest rates ultimately rise.

In sum, for many other central banks, recent Swiss economic data might well be viewed as soft enough to at least put policy tightening on hold. However, the SNB is loath to let its price stability credentials slip and even an inflation rate of 2.2 percent is unacceptably strong. Just last week, President Thomas Jordan suggested that the neutral policy rate was probably around 2 percent, implying that current levels are not even restrictive and intimating that even a 25 basis point hike on Thursday would not be the last in the cycle. Still, the next MPA is not due until September and unless the domestic economy regains some momentum, by then both headline and core inflation could easily be sub-2 percent. Either way, the peak to interest rates should not be too far away.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings. The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day.

The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day. Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.

Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.