Edited by Simisola Fagbola, Econoday Economist

The Economy

Monetary policy

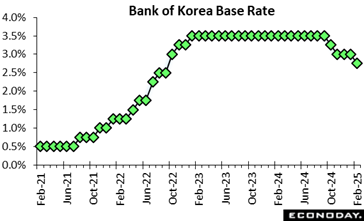

Since the previous BoK meeting last month, data have shown an increase in headline inflation from 1.9 percent in December to 2.2 percent in January, with core inflation also edging higher. Export growth, however, has weakened, while domestic political instability has also weighed on consumer and business sentiment.

In the statement accompanying the decision, officials expressed confidence that inflation will remain stable, retaining their forecast for annual headline inflation to be 1.9 percent this year and for annual core inflation to be 1.8 percent. Officials, however, are now less confident about the growth outlook, partly reflecting their concerns about US trade policy. They have revised down their forecast for annual GDP growth this year from 1.9 percent to 1.5 percent.

At their last meeting, officials left rates on hold partly because they were concerned about exchange rate volatility following December’s short-lived period of martial law. Although these concerns remain, officials concluded that the weaker growth outlook warranted another rate cut in order to "mitigate downward pressure on the economy". They also signalled that additional policy loosening will be considered in upcoming meetings.

Inflation

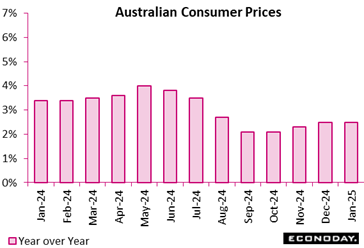

Steady headline inflation in January reflects offsetting moves among major categories. Automotive fuel prices fell 1.9 percent on the year after a previous decline of 1.4 percent while electricity prices dropped 11.5 percent on the year after a previous decline of 17.9 percent. This fall in electricity prices was mainly driven by government rebates. Food prices rose 3.3 percent on the year after a previous increase of 2.7 percent, while communication prices fell 0.6 percent after a previous fall of 0.1 percent. Underlying measures of inflation, however, increased, with the trimmed mean measure picking up from 2.7 percent to 2.8 percent, and the measure excluding volatile items and holiday travel increasing from 2.7 percent to 2.9 percent.

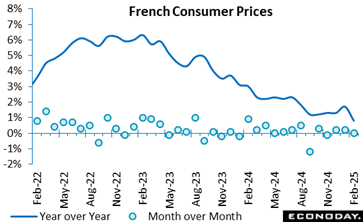

Consumer prices remained stable monthly, as a rebound in manufactured goods prices after winter sales was offset by falling electricity costs. Food prices dipped slightly, while services saw a modest acceleration, reflecting demand resilience in non-essential spending.

The harmonised index of consumer prices followed a similar trajectory, rising just 0.9 percent year-over-year, compared to 1.8 percent in January. This reinforced the broader disinflation trend across the Eurozone while it remained stable over the month.

With inflation below 1 percent, the key question is whether this signals a long-term easing of price pressures or if rising food costs and resilient service demand could trigger a rebound. Lower energy prices may provide relief, but consumer sentiment and wage dynamics will shape the inflation outlook.

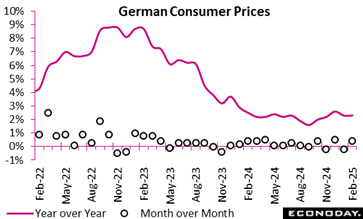

Core inflation, which excludes volatile items like food and energy, is estimated at 2.6 percent, emphasising persistent underlying price pressures. This suggests that inflation is not solely driven by external shocks but also by structural factors within the economy.

If core inflation remains elevated, calls for caution in interest rate reductions may intensify. For consumers, the steady price increases could continue to weigh on purchasing power, potentially influencing spending behaviour in the coming months.

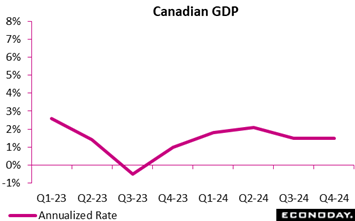

GDP

Higher household spending, as well as increased exports and business investment drove the increase in economic activity. This was partially offset by declines in business inventories and higher imports (possibly to get ahead of U.S. tariffs).

Household spending jumped 1.4 percent, the strongest growth rate since Q2 2022. The biggest contributor was increased spending on new trucks, vans and sport utility vehicles, followed by greater consumption of financial services.

It is worth noting, according to StatsCan analysis, that new trucks, vans and sport utility vehicles is the household category that is the most dependent on U.S. imports, with 46.7 percent share of total imports.

Per capita household expenditures ticked up by 1 percent in the fourth quarter, but is down 0.6 percent for all of 2024.

Business investment in non-residential structures rose 0.7 percent in the fourth quarter, led by building construction (+1.6 percent). Investment in machinery and equipment increased 4.2 percent in the fourth quarter, powered by increased spending on industrial machinery and equipment and aircraft and other transportation equipment and parts, “which coincided with increased imports of aircraft and ships.”

In 2024, business investment in non-residential structures fell by 1.8 percent, led by a decline in building construction (-3.4 percent).

The data is in line with the Bank of Cananda’s expectation for a gradual increase in the pace of growth as interest rate cuts boost consumption. However, the significant downside risk from tariffs – which could go into effect soon as March – means the central bank might be forced to take actions that are even more aggressive in the near term to prop up the economy.

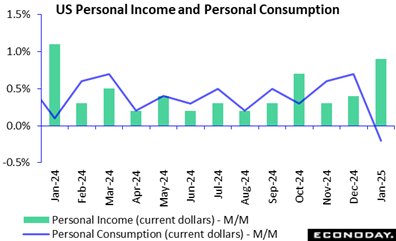

Demand

Personal consumption expenditures are down 0.2 percent in January from December, below the consensus of up 0.2 percent. Spending on durables falls 3.0 percent in January as consumers moved up purchasing big ticket items like motor vehicles and appliances back in November and December in anticipation of higher prices and possible supply shortages. Spending on nondurables is down 0.2 percent and is likely in part due to less volume gasoline purchases as consumers were stuck at home during a long bout of bitter winter weather. Spending on services is up a small 0.3 percent in January from the prior month and shows some moderation from the recent trend.

The PCE is up 0.3 percent in January from December, the same increase as in December from November. On a monthly basis, prices are rising a bit faster than previously. The core PCE deflator is up 0.3 percent in December from the prior moth and picks up the pace slightly from the prior two months. Compared to a year ago, the PCE deflator is up 2.5 percent, a tenth higher than the up 2.6 percent in December and the same as up 2.5 percent in November. The underlying trend in the past few months is fairly steady and indicates that progress in disinflation is stalled. The core PCE deflator suggests that price pressures are more from food and energy costs. The core PCE deflator is up 2.6 percent in January from the year-ago month, three tenths lower than the up 2.9 percent in December.

The PCE deflator is the FOMC’s preferred measure of inflation. The January readings will not change Fed policymakers’ view that inflation remains somewhat elevated and more work needs to be done to bring it down to the 2 percent objective.

US Review

Watch the Consumer

By Theresa Sheehan, Econoday Economist

US consumers appear to be experiencing a sharp drop in confidence. While there was uncertainty in the second half of 2024 during the contentious period leading up to the presidential election, it did not seem to affect consumers’ attitudes about the economic fundamentals all that much. The labor market was strong and income gains relatively steady and solid. However, since year-end, concerns about the near future are increasingly elevated, especially in terms of job security.

The Conference Board’s February consumer confidence index is down for a third month in a row with a 7.0 point drop in February to 98.3 which is the lowest since 97.8 in June 2024. There is a particularly acute decline of 9.3 points in the expectations index to 72.9 in February, the lowest since 72.8 in June 2024. These sorts of readings for the near future point to a greater possibility of a recession on the horizon.

The report also included a jump in the 1-year inflation expectations to 6.0 in February from 5.2 in in January.

While the soft January data on retail sales might have been due to exhausted demand after a strong fourth quarter 2024, it is also possible that declining confidence among consumer will mean weakening consumer spending in the first quarter 2025, especially for discretionary purposes. The January data on personal consumption showed a 0.2 percent decline that was mostly due to a 3.0 percent drop in spending on durables. Consumers were active in buying hard goods in November and December 2024 in anticipation of higher prices and leaner supplies if proposed tariffs were imposed. Demand for things like motor vehicles and appliances is going to be weaker as households reassess their spending in 2025.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings. The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day.

The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day. Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.

Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.