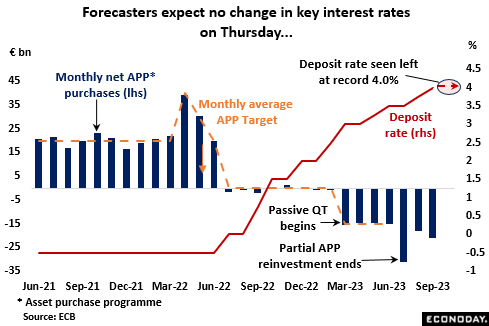

Investors were split over the likelihood of further tightening ahead of the ECB’s September meeting but there is a much broader consensus in favour of no change going into this Thursday’s announcement. Last month’s decision was clearly far from unanimous with some Governing Council (GC) members wanting at least a pause in interest rate hikes and others unhappy with a policy statement hinting that official rates might have peaked. Since then, additional signs that inflation has started to behave itself combined with the steadily rising risks of Eurozone recession have led most to believe that time is now needed to assess the effects of what has been a remarkable 450 basis points of tightening since July 2022. If so, the key deposit rate will remain at its current record high of 4.00 percent, the refi rate at 4.50 percent and the rate on the marginal lending facility at 4.75 percent. The focus then will be on any changes made to the ‘soft’ forward guidance issued last month that said “…the Governing Council considers that the key ECB interest rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target.”

However, even with steady interest rates, QT continues to chip away at the level of policy accommodation. Having terminated partial reinvestment at the end of June, assets held under the longstanding asset purchase programme (APP) declined by nearly €75 billion in the third quarter to €3.11 trillion. This compares with a €47.1 billion fall in the second quarter and left holdings at their lowest level since October 2021. Nonetheless, with signs that key interest rates might have topped out, the hawks will be all the keener to shrink the balance sheet faster by including the pandemic emergency purchase programme (PEPP) in the QT programme. Any such move would be resisted by the doves and has probably been made less likely by recent developments in the bond market. Earlier this month the key 10-year German bund-Italian BTP spread climbed above 200 basis points, the level seen by many as a warning flag for Eurozone financial stability and, as such, a potential threat to the single currency. Spreads narrowed again after the Hamas attacks on Israel but are still around 200 basis points. Importantly though, so far there appears to have been no discussion about activating the Transmission Protection Instrument (TIP). This was introduced in July 2022, aimed at ensuring the smooth transmission of the monetary policy stance across the entire region and, as part of that goal, countering unwarranted, disorderly market dynamics.

September’s policy statement left financial markets largely convinced that key interest rates had peaked and, if anything, that view has been reinforced by the latest data. In fact, current levels match the 4.0 percent high currently priced in for 3-month money rates in December/January. However, expected ECB easing in 2024 has become slightly more cautious with rates now put at about 3.40 percent at year-end, up 15 basis points from the pricing just before the last meeting.

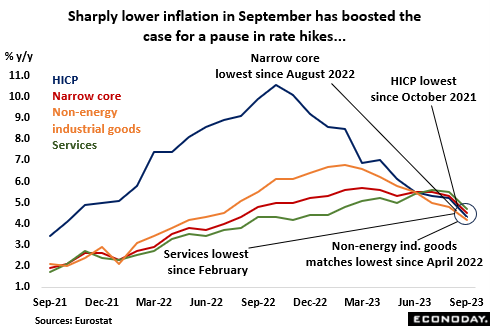

Despite a fall in the core rates, the August inflation report was not soft enough to prevent September’s 25 basis point tightening. However, it at least bolstered the chances that underlying price rises were trending in the right direction and, since then, the September data have supported that view. Although strongly negative base effects played a key role, the narrow core gauge declined to a surprisingly low 4.5 percent, its weakest reading since August 2022. Moreover, the monthly rise in the seasonally adjusted wider core index that excludes just food and energy was the smallest since it last fell back in April 2021. With inflation in services also down sharply at 4.7 percent, this apparent broad-based loss of price momentum has significantly boosted the case to leave policy on hold.

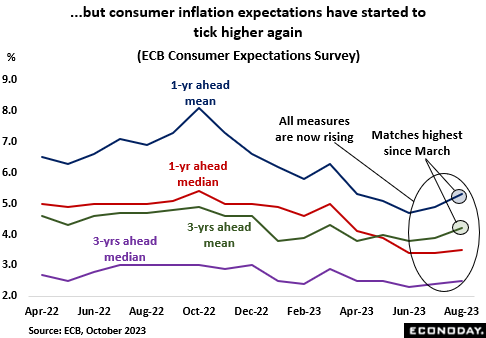

Even so, it has not all been one-way traffic. According to the central bank’s own survey, consumer inflation expectations, a key input into policy decisions, have deteriorated since September’s meeting. Although well off their respective peak levels, on average households now see both the 1-year ahead and 3-year ahead rates at least matching their highest mark since March. This probably reflects the recent rise in oil prices but, with the labour market still very tight, the increases will still trouble the GC’s hawks. A similar picture was also apparent in the EU Commission’s latest survey although, importantly, this also found expected selling prices in services, currently a major ECB focus, falling to their lowest level since September 2021.

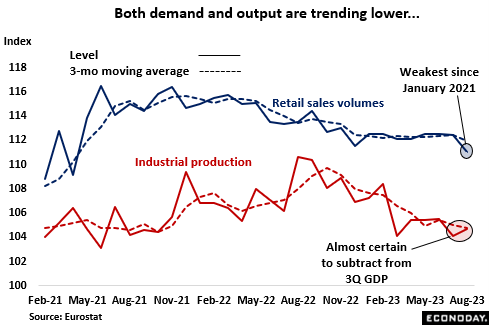

What is clear is that the Eurozone economy is struggling to keep its head above water. To all intents and purposes, real GDP has not grown since the third quarter of last year and, contingent upon last quarter’s data (preliminary flash due next week), might even have contracted. Retail sales volumes have been trending down since April of 2022 and, much more sharply, industrial production since last October. Business and consumer surveys remain soft, both narrow (M1) and broad (M3) money supply are contracting at record yearly rates and the ECB had to revise down (again) its growth projection in its September forecast update.

In particular, activity in construction, the region’s most interest rate-sensitive area, has responded to rising borrowing costs by declining at a pace not seen since the early days of Covid. From 56.6 in February 2022, the last time that all the largest three members posted at least 50, the sector PMI fell to just 43.6 in September. This is deep in recession territory and in no small way due to Germany where the national PMI now stands at a lowly 39.3. At 43.7, France is only slightly better off and, in both countries, housing is especially weak. Ominously, new business across the Eurozone is currently falling more rapidly than at any time since May 2020 and expectations are for more of the same through into next year.

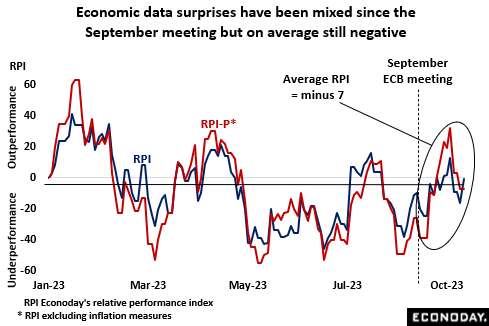

Compared with earlier in the year, surprises in the economic data since the September meeting have been more mixed. However, the average value of Econoday’s relative performance index (RPI) was still mildly negative (minus 7), showing a downside bias to overall activity versus market expectations. Indeed, the broad picture since early May remains one of an underperforming economy for which recession risks have continued to rise. As always, inflation will dominate this week’s talks but outside of that, the data play mainly into the hands of the doves.

September’s dovish forward guidance, combined with subsequent disinflationary and, potentially recessionary, real economy data, has left investors widely anticipating no change in ECB policy this week. However, a steady hand now would not preclude additional tightening further out and the central bank will be keen to rule out any early cuts. That said, with QT running in the background, official interest rates could be on hold for some time.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings. The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day.

The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day. Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.

Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.