Should the central bank see fit to ease at what would be a third successive Monetary Policy Assessment (MPA), there would seem to be few hurdles in the path of another cut in the SNB’s policy rate this week. Inflation remains low, the Swiss franc strong and domestic economic activity, at best, sluggish. In addition, both the ECB and the Federal Reserve have reduced their key rates since the June MPA. The bank has a habit of surprising investors but there is a strong market consensus favouring another 25 basis point reduction in the benchmark rate to 1.0 percent. This would match its lowest level since December 2022. Note that this will be the last MPA for current SNB President Thomas Jordan who leaves the bank at the start of next month. His position will be taken by Vice President Martin Schlegel.

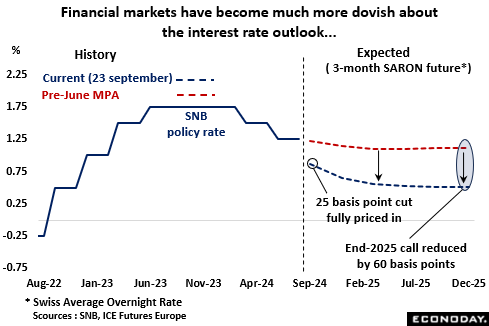

In fact, financial markets have significantly lowered their expected profile for interest rates through 2025. A 25 basis point reduction this week is fully priced in and 3-month money rates are now seen bottoming around 0.5 percent in the middle of next year. That would be nearly 0.6 percentage points beneath what was predicted just before the June MPA. If correct, it would almost certainly mean that the SNB’s easing cycle will be completed well ahead of most other major central banks.

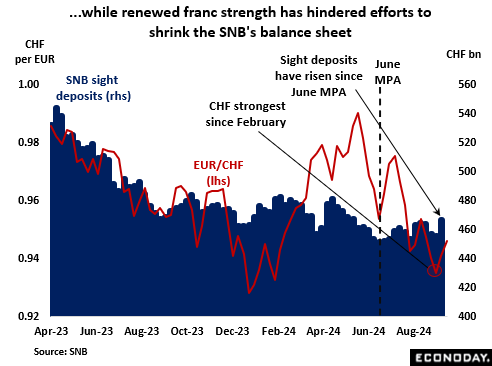

Efforts to shrink the SNB’s bloated balance sheet have been largely unsuccessful this year. At CHF812.4 billion in June, total assets were more than 2 percent larger than at the end of 2023. In part, this reflects the strength of the Swiss franc which has restricted the scope for the disposal of foreign currency holdings. Amidst the recent heightened volatility in financial markets, the safe haven appeal of the Swiss unit has been further boosted by the unwinding of some longstanding short yen carry trades. Indeed, at CHF0.930 versus the euro early last month, the cross-rate was probably close to the central bank’s pain threshold. As such, some limited depreciation might be welcome, further increasing the likelihood of a rate cut.

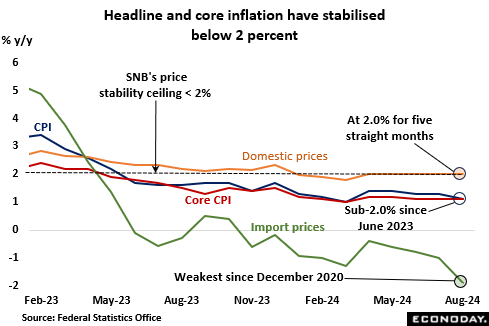

Inflation developments since the June MPA hardly stand in the way of another ease. The August report saw the annual CPI rate dip to just 1.1 percent, a 5-month low, well within the bank’s definition of price stability and matched by the core measure. Both gauges have been consistently below 2 percent since June last year. Domestic prices are rising at a rather faster 2.0 percent but have been steady at that pace since April and that level did not prevent June’s reduction in the policy rate.

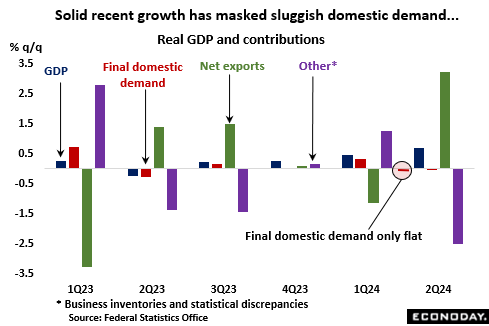

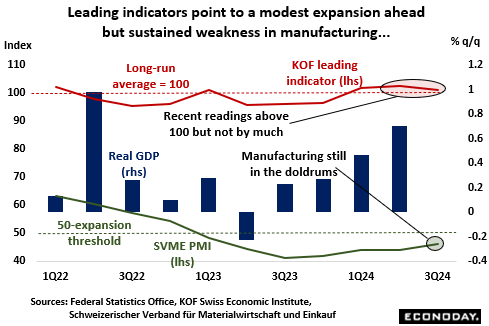

Economic growth looked surprisingly robust in the second quarter. Following an unrevised 0.5 percent quarterly increase at the start of the year, GDP expanded fully 0.7 percent, its best performance since the second quarter of 2022. However, final domestic demand was only flat as limited gains in household and government spending were offset by a sizeable decline in gross fixed capital formation, worryingly its fourth contraction in the last five quarters. Consequently, growth was heavily dependent upon net exports although, even then, both sides of the balance sheet posted hefty falls.

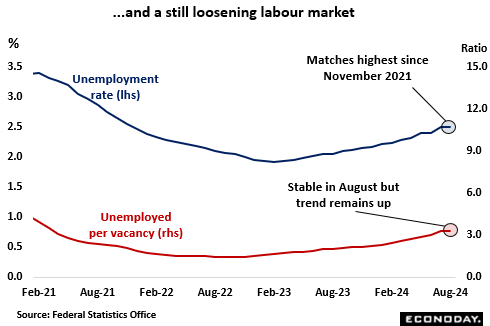

Meantime, the labour has continued to loosen, albeit still only gradually. Since the June MPA, unemployment has risen more than 7,300 or nearly 7 percent, and, at 2.5 percent, the current jobless rate matches its highest reading since late 2021. Vacancies last month increased too but the trend remains down and the August level was still some 22 percent below the level a year ago. Indeed, the ratio of unemployed to vacancies matches its highest mark since March 2021.

Leading indicators point to slightly above average growth over coming month although the outlook for manufacturing, despite a sharp jump in August’s SVME PMI (49.0), remains generally gloomy. In fact, without a pick-up in global growth, the recovery could well slow as unemployment continues to rise and flatlining consumer confidence keeps a lid on household spending.

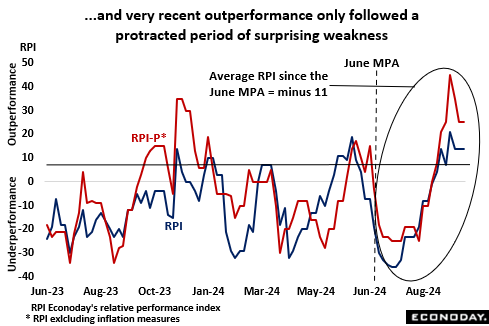

Very recent economic data have actually proved stronger than expected, lifting Econoday’s Relative Economic Performance Index (RPI) back above zero. However, the last nine months have been dominated by downside surprises and, since the June MPA, the RPI has averaged minus 11. Over the same period, the mean value of its inflation-adjusted counterpart (RPI-P) was rather stronger, but still negative at minus 3. Accordingly, the broader economic picture still favours a slightly looser monetary stance.

The bottom line then is that if the SNB wants to cut again this week, it has plenty of scope to do so. That said, with inflation currently at 1.1 percent, the widely anticipated 25 basis point reduction would leave the real policy rate below just zero. This would suggest a more cautious approach to cuts going forward.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings. The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day.

The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day. Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.

Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.