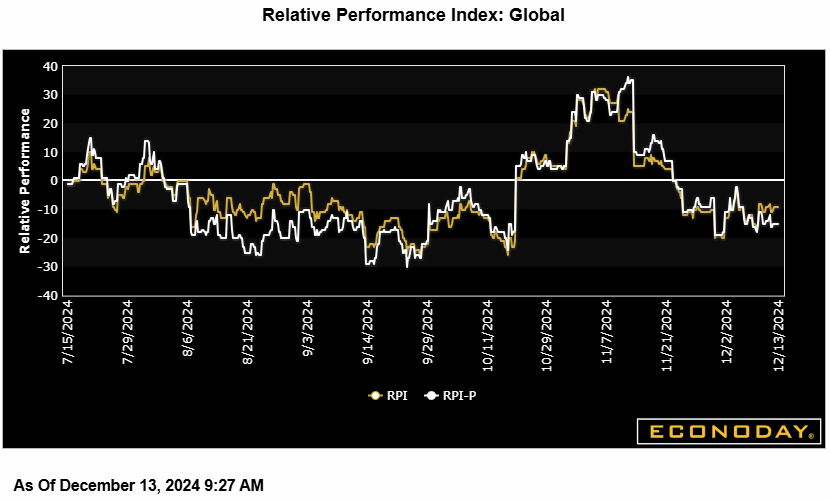

Econoday’s Relative Economic Performance Index (RPI) closed out last week at minus 4. While not significantly below zero, this extended its unbroken run of sub-zero readings to three weeks and, with the RPI-P at minus 13, helped to justify the latest round of central bank interest rate cuts. Japan is now slightly outperforming while the U.S. and Canada broadly match expectations. However, China is running well behind and both the Eurozone and the UK are still struggling to keep up.

In the U.S., both the RPI (6) and RPI-P (minus 3) continue to show economic activity in general behaving much as anticipated. With November inflation also offering no surprises, the Federal Reserve remains on course to announce another 25 basis point cut this week.

In Canada, the latest 50 basis point ease by the Bank of Canada came as no surprise to anyone. However, with the RPI (minus 4) now showing recent economic activity performing much as forecast, it made sense for Governor Tiff Macklem to signal that the bank would be adopting a more gradual approach to rate cuts going forward.

The European Central Bank’s 25 basis point cut last Thursday was similarly already fully discounted in financial markets, Eurozone economic activity having quite consistently undershot already weak forecasts since the central bank’s last meeting in November. Indeed, persistent sub-zero readings were reflected in the central bank’s decision to further downgrade its GDP growth projections. The region’s RPI and the RPI-P closed out the week at minus 5 and minus 10 respectively, still showing very modest underperformance.

In the UK, an unexpected contraction in October GDP helped to ensure that the RPI-P (minus 27) remained well below zero despite some more positive signs about activity in November. The RPI (minus 5) is much closer to zero but both measures have shown downside surprises dominant since late October. Accordingly, another cut in Bank Rate this week remains a possibility but, having already eased just last month, the Bank of England’s preference to adjust policy only gradually argues against.

In Switzerland, recent economic activity has performed broadly in line with forecasts. Both the RPI and RPI-P stand at minus 2 but with neither gauge having been in positive surprise territory since October and the Swiss franc still very strong, the Swiss National Bank clearly felt obliged to ease buy a full 50 basis points last Thursday.

In Japan, slightly higher than expected November PPI inflation and a marginally more upbeat Bank of Japan Tankan survey lifted the RPI to 23 and the RPI to 14. The data also helped to underpin speculation about another round of interest rate hikes soon but investors remain split over whether this will be delivered as soon as this week.

In China, last week’s unexpected official acknowledgement that monetary policy should be loose hints at additional stimulus to come. This should not surprise with the RPI (minus 21) and RPI-P (minus 30) showing economic activity still undershooting forecasts, as it has for much of the latter half of the year so far.

Econoday’s RPI provides a handy summary measure of how an economy has recently been evolving relative to market expectations.

A reading above zero means that the economy in general has been performing more strongly than expected and vice versa for a reading below zero. The closer is the value to the maximum (+100) or minimum (-100) levels, the greater is the degree to which markets have been under- or over-estimating economic activity. A zero outturn would imply that, on average, the market consensus has been correct. Note too that the index is sensitized to place extra weight upon those indicators that investors consider to be the most important.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings.

Econoday’s Global Economics articles detail the results of each week’s key economic events and offer consensus forecasts for what’s ahead in the coming week. Global Economics is sent via email on Friday Evenings. The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day.

The Daily Global Economic Review is a daily snapshot of economic events and analysis designed to keep you informed with timely and relevant information. Delivered directly to your inbox at 5:30pm ET each market day. Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.

Stay ahead in 2025 with the Econoday Economic Journal! Packed with a comprehensive calendar of key economic events, expert insights, and daily planning tools, it’s the perfect resource for investors, students, and decision-makers.